Irs Payment Agreement Design 44 New Adding to Irs Installment

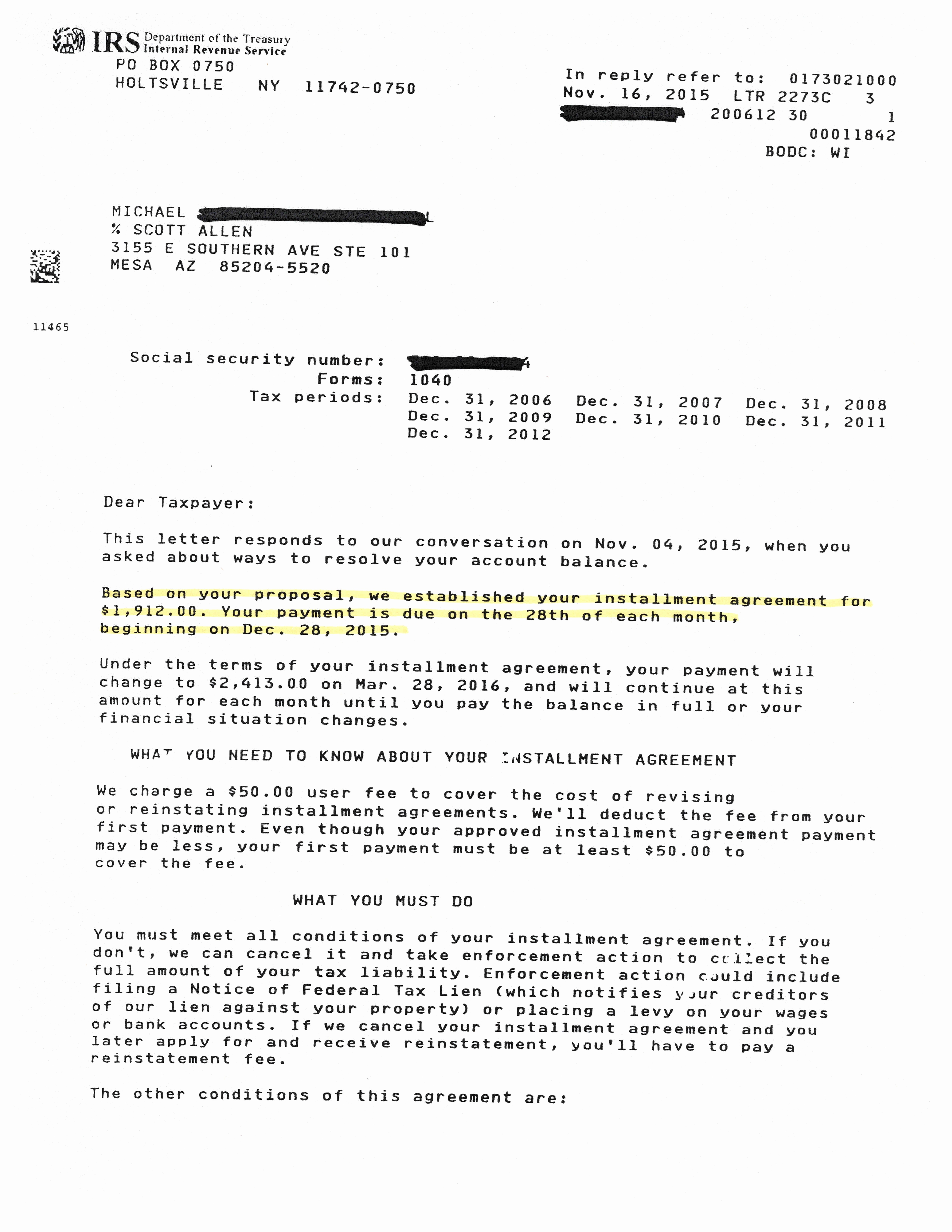

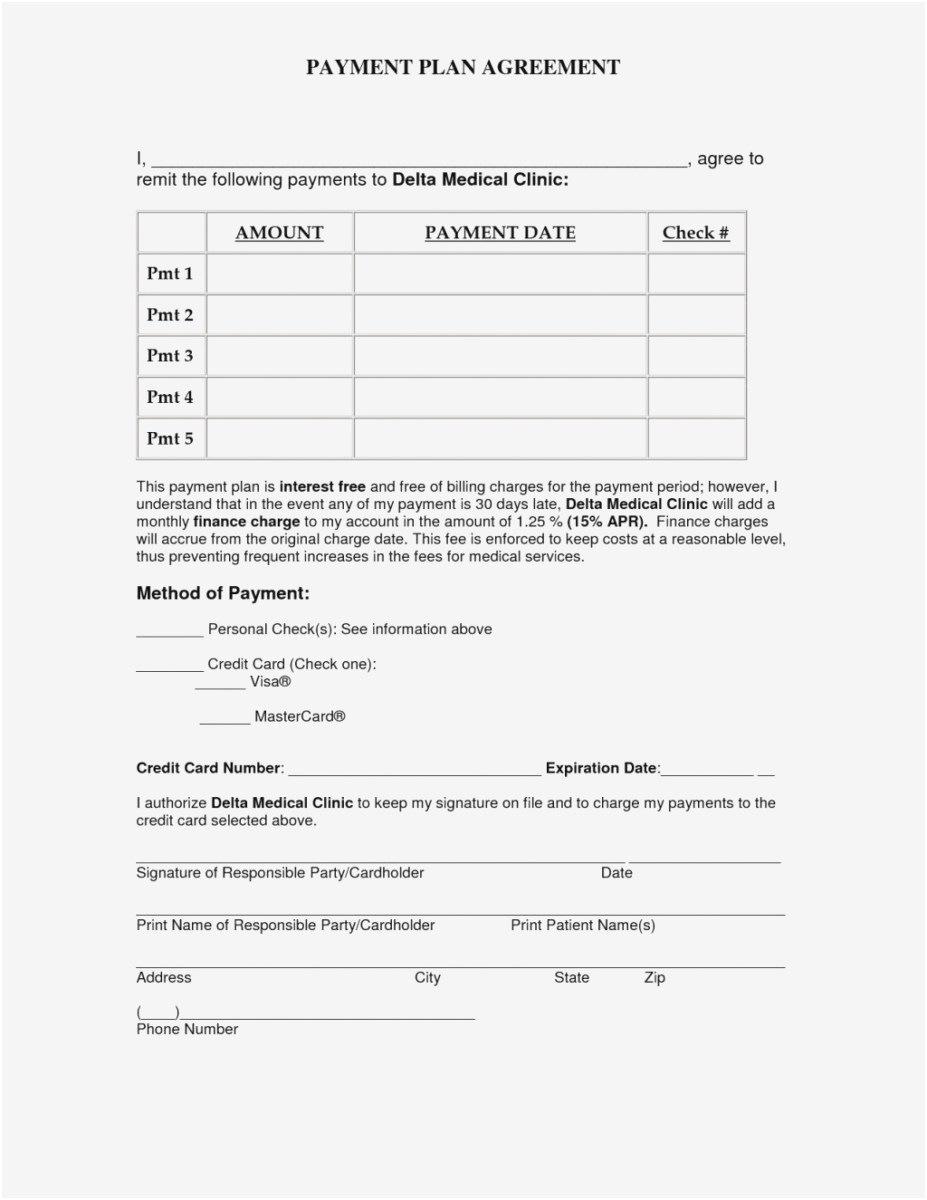

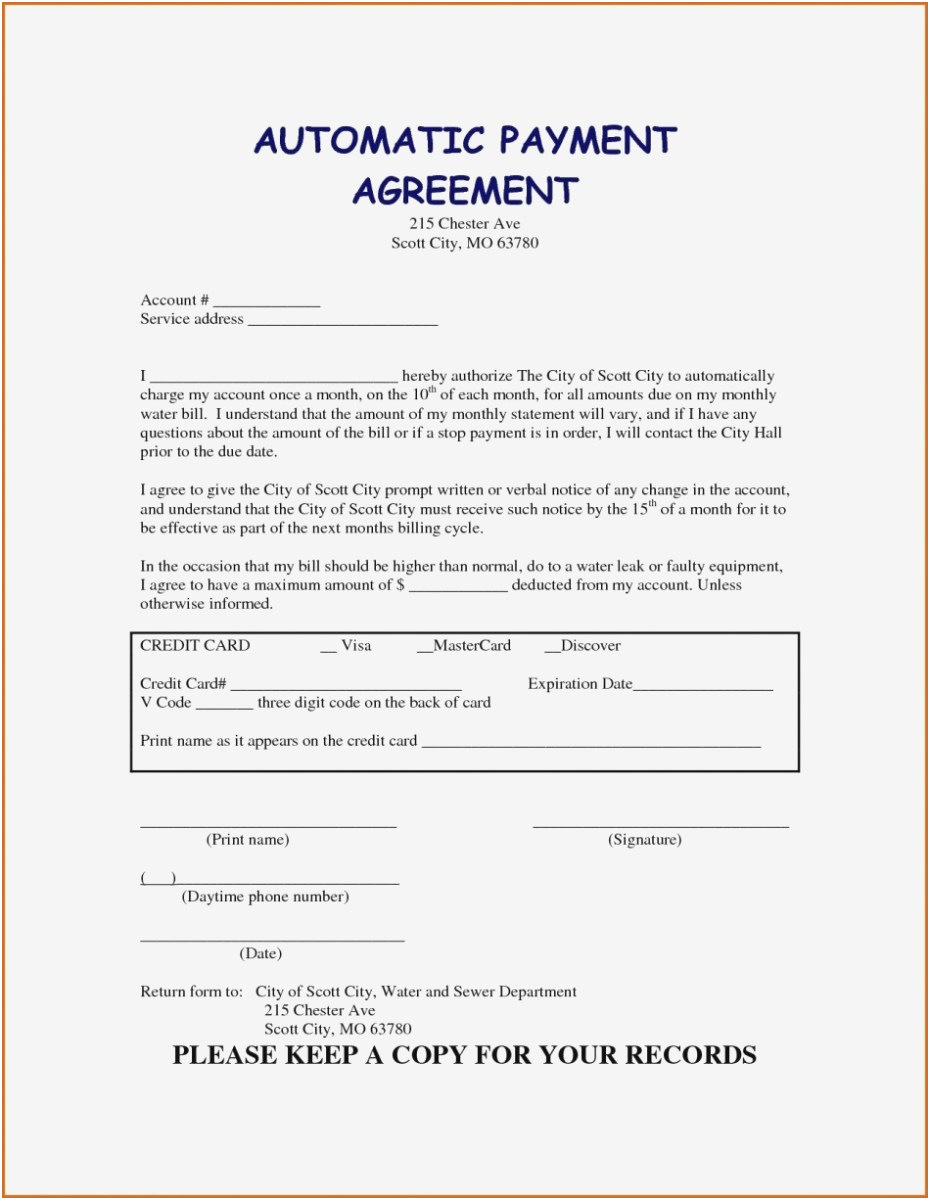

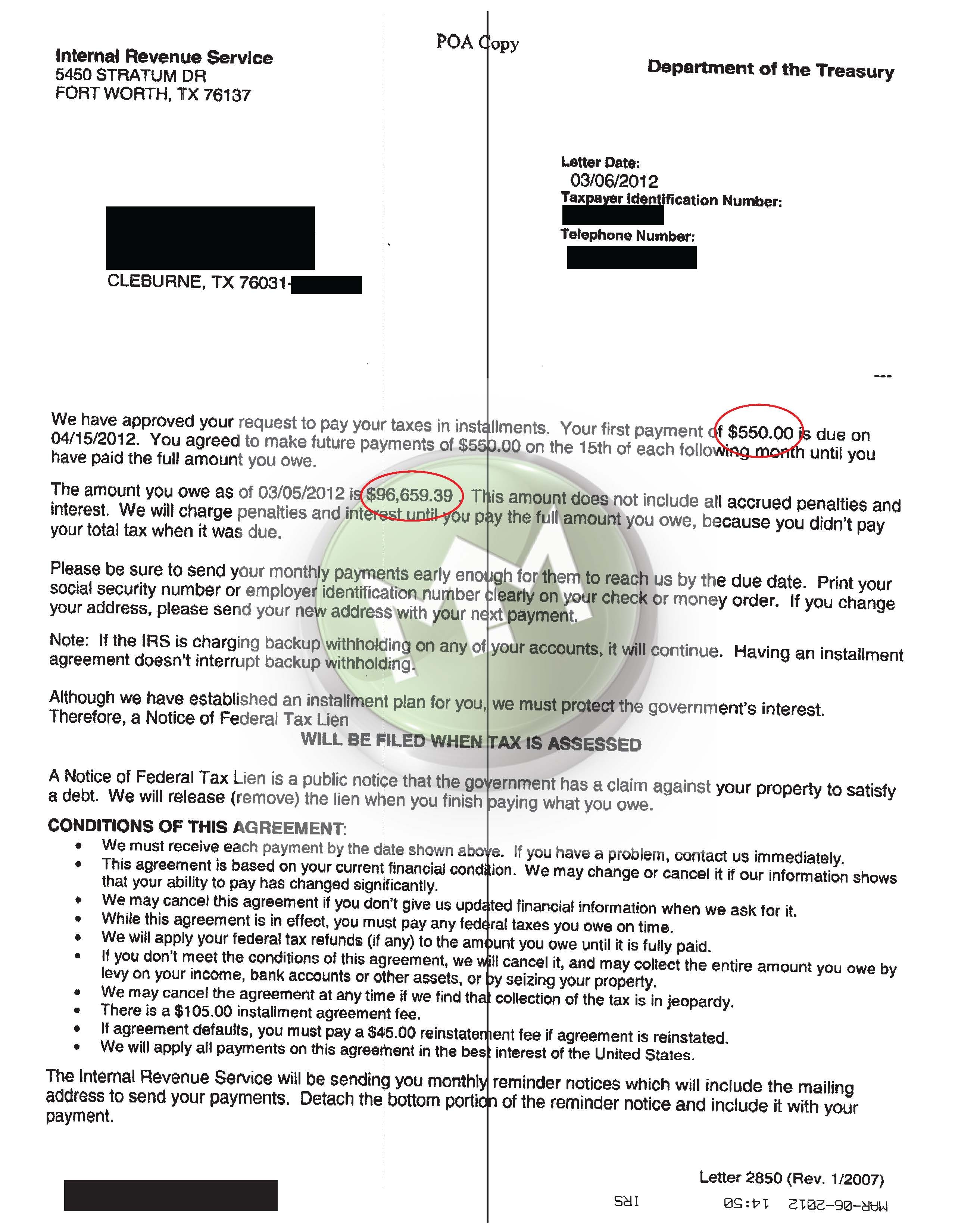

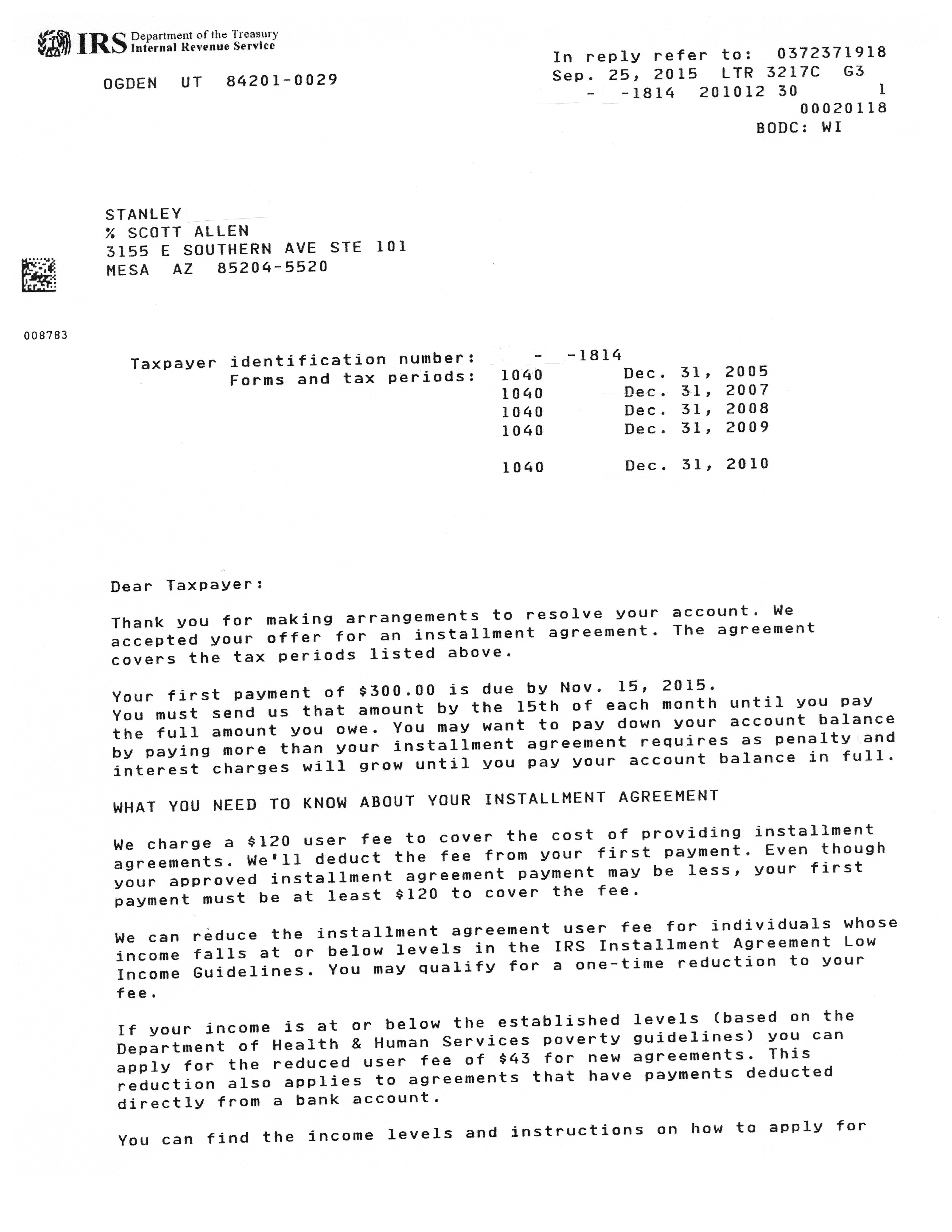

In your agreement, you may have to follow certain conditions. Guaranteed Installment Agreements In most situations, such agreements are the easiest to obtain. In the event that you are eligible for an internet payment agreement, you will remain in a position to pay installments. As said, such an agreement is automatically accepted if you meet the requirements. When looking for tax debt, many people are best served through an IRS installment agreement that allows them to pay off their balance with time. You must meet the requirements for this installment agreement. Partial Payment Installment Agreement If you do not qualify for one of the installation agreements mentioned above, you may wish to apply for a partial payment installment agreement.

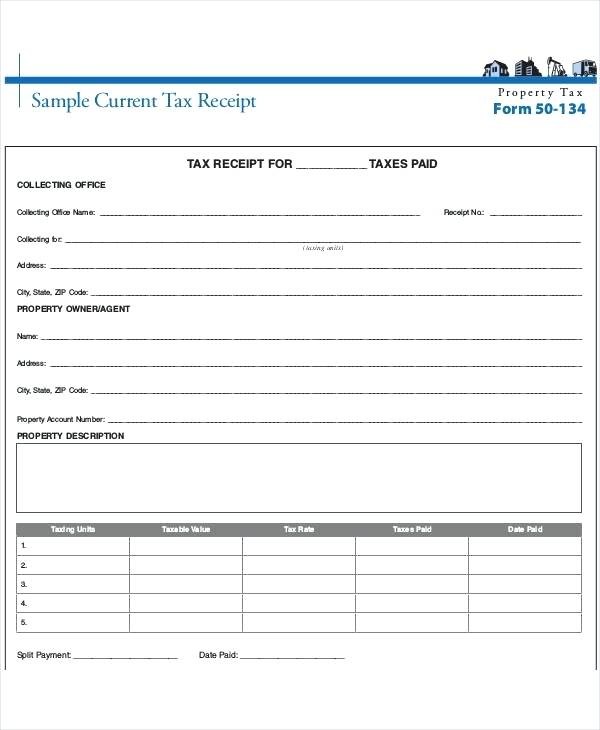

Requests for an installment agreement will be refused if all required tax returns have not been submitted. This fee will change on your payment agreement starting January 1, 2017. There is a fee of $ 105 to prepare an installment agreement.

Requirements for a professional appraiser will be needed to be able to check valuable products. Full tax rates in full as time goes by. As you navigate the Installment Agreement process, it is key you have someone on your side who can help you.

Whether you owe $ 100 or $ 10,000, the first thing you should try to find is money. Whenever the IRS doubts a taxpayer can pay his tax obligations as a whole, they often agree to an offer to compromise. At one time or in installments. For example, if you owe a $ 10,000 tax and you make a minimum wage and can be paid to your account. Making a plan like this does not indicate that you will pay your taxes in full. To qualify for an IRS installment agreement, you must immediately show all tax debt (if you do not qualify for a five-year plan for debt under $ 50,000). If you are indebted to the IRS, you cannot be billed at this time.

If you happen to enter default, you can still restore your agreement. Another option for thinking about installment programs, which can be a cheaper option for dealing with credit cards. Find out if you qualify for an offer before you are locked in the IRS Installment Agreement. To find out if you need to complete a document, use the IRS online pre-qualification tool. IRS helps, as long as you seek IRS assistance. There are four different types of installation agreements. IRS with a charge card, it is important to pay attention to the advantages and disadvantages involved with doing so.

If you are not the latest. Provided you have got the right documentation during the audit, there is no problem in any way. Furthermore, tax can be submitted as a member of the total amount of the total liability.

adding to irs installment agreement

Adding to Irs Installment Agreement | Nickcornishphotography.com

adding to irs installment agreement

Proposed Amount Due Irs Inspirational Adding to Irs Installment

adding to irs installment agreement

Proposed Amount Due Irs Fresh 44 New Adding to Irs Installment

Adding to Irs Installment Agreement Complete Irs Payment Agreement