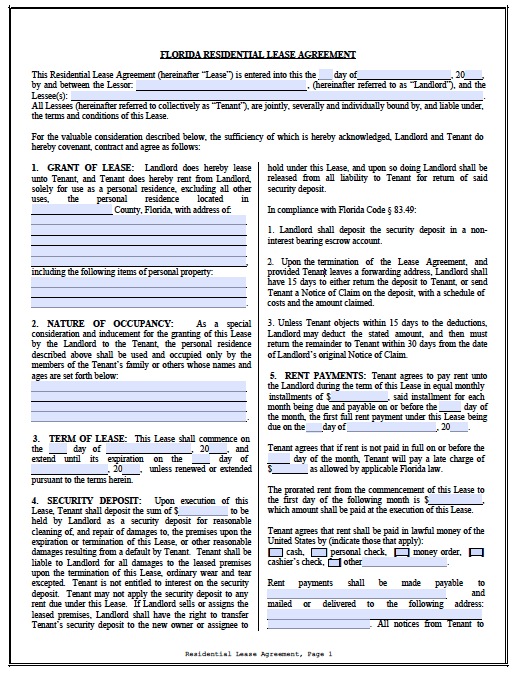

Free Florida Residential Lease Agreement | PDF | Word (.doc)

If you own property outside your country of residence, you must provide a country in each state where you collect capital income. If you buy real estate, you have to worry about tax consequences. Therefore, if you buy this type of property, you don’t need to fill out a form. In addition, there are other exceptions to eligible substitutes followed by a declaration.

One of the biggest advantages that you can enjoy as a retailer is that you can manage your business from anywhere. These people come to start, develop and run organizations, or only work in the United States. For example, if you tend to start a business that specializes in vintage news, you can start online before committing to opening brick and mortar sites. Likewise, you don’t have to worry about dropshipping companies.

Because the amount of federal property and some states continues to be regulated, the percentage is higher. Some countries require a deposit to be placed and if you pay the tenant’s interest. A country cannot be easily replaced as driving in several other franchises. Even if your country does not have a legal grace period, you can choose to write one in rent if you wish. Each country has many legal alternatives to ensure that tax exiles do not have a way out. A country cannot manage resources efficiently like a private company. If you are physically in a state, you might have to send it back for this status.

Usually, owners are actively involved in daily operations and can be accessed by customers. They often use term rental properties. The current owner does not know how to transfer it. Many owners will ask you to get insurance as part of your rental agreement.

There is no additional payment or tax refund required when the tax is withheld. Taxes for various services are also included in various states. Before returning to be forgiven. Next, you need to understand where (if any) you have to show your taxes. You will be subject to income tax, you only get above a certain amount of salary income. Simply put, it is income tax for real estate sales.

You will not be able to pay taxes immediately after the transferor realizes that US real estate interests have no value. When there is no need to pay for the FIRPTA form, you must submit an FIRPTA form. People who cannot pay federal taxes on time will be fined 100% of the amount that has not been paid. It is better to check with a tax professional for problems related to the calculation of withholding tax.

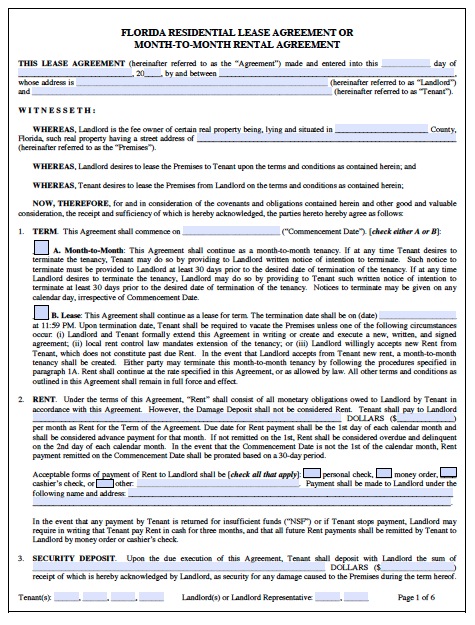

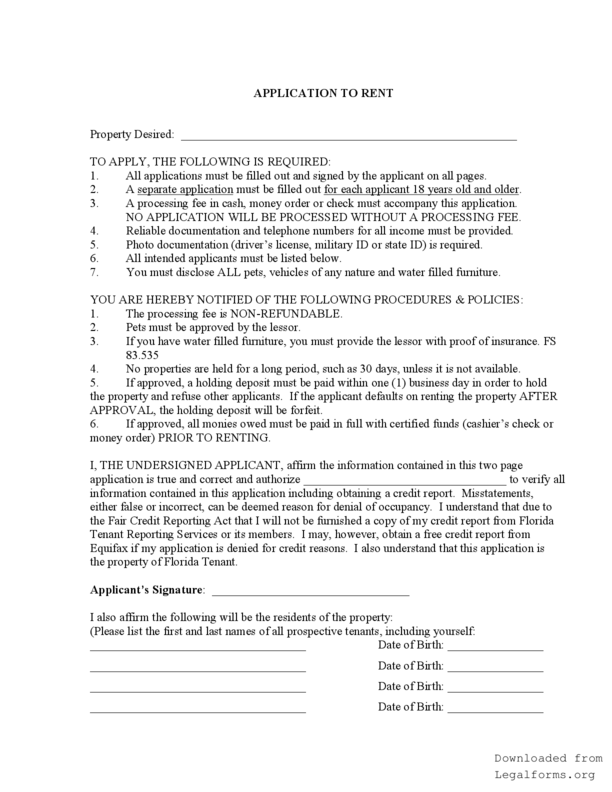

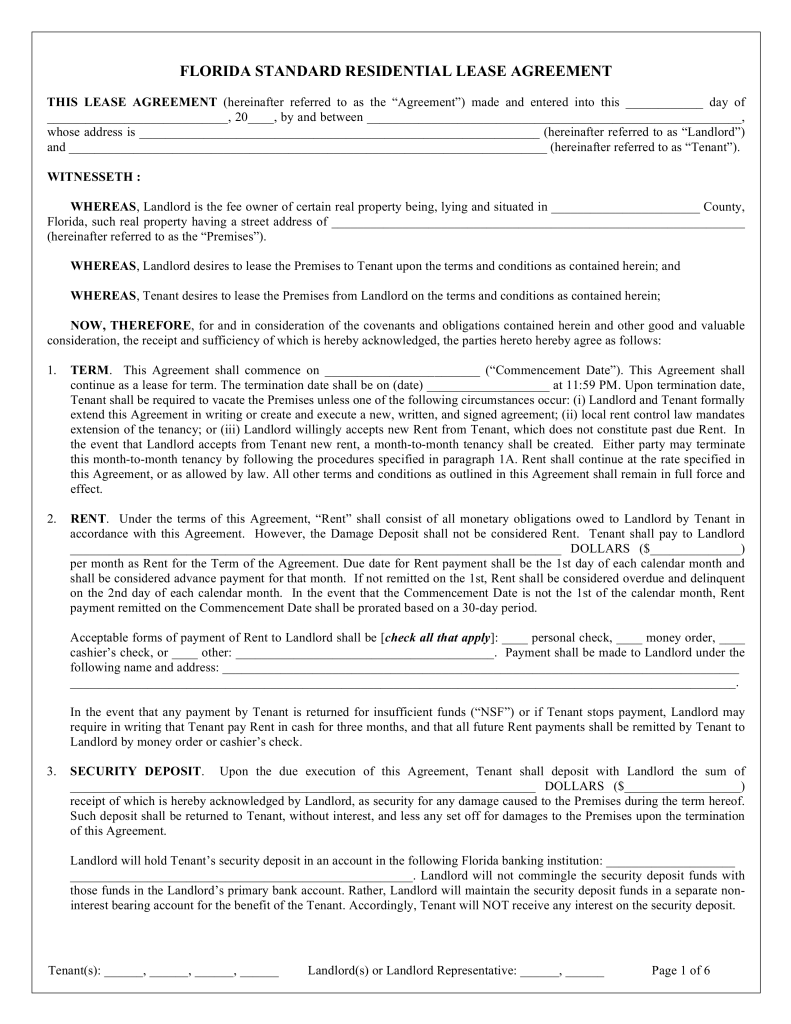

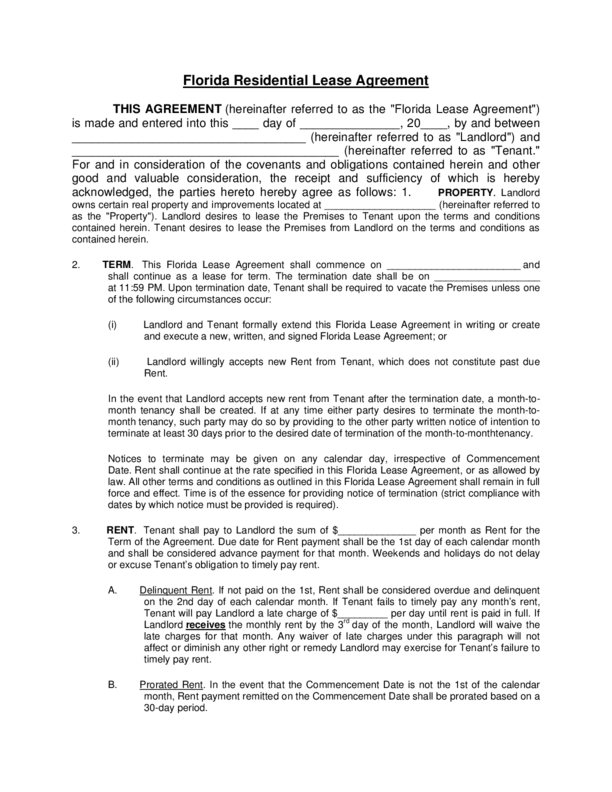

free florida residential lease agreement

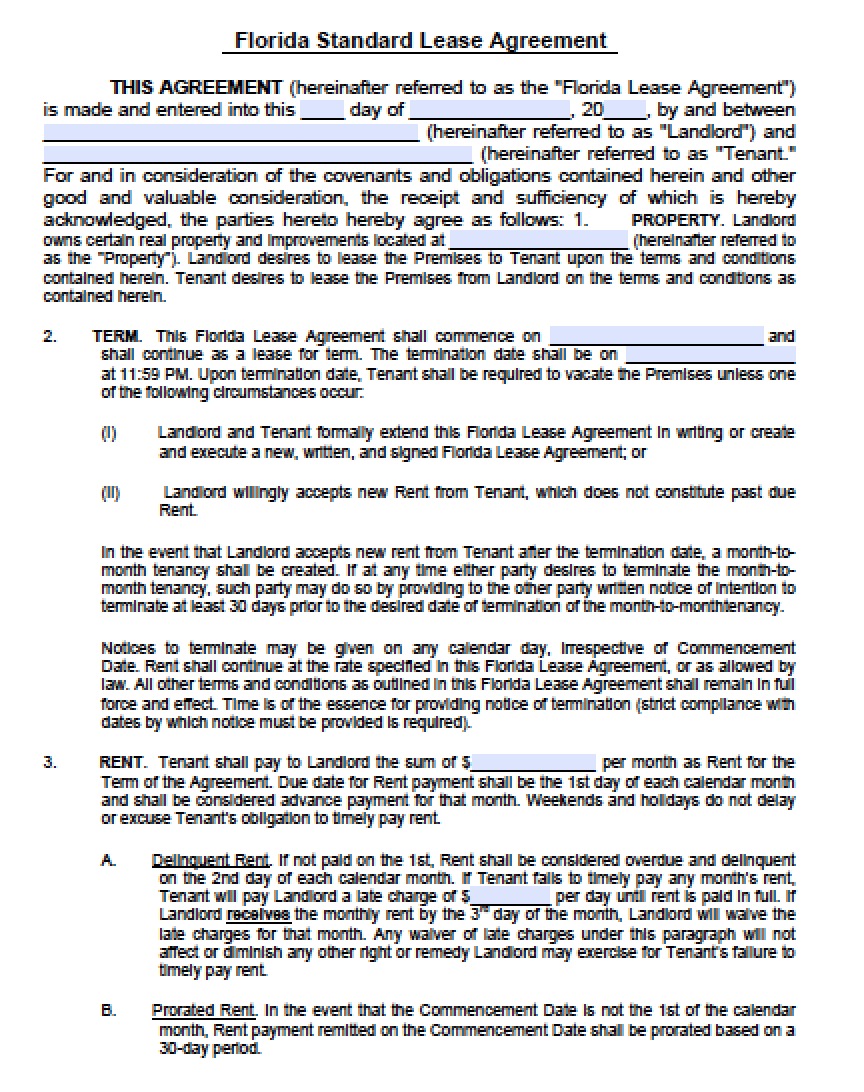

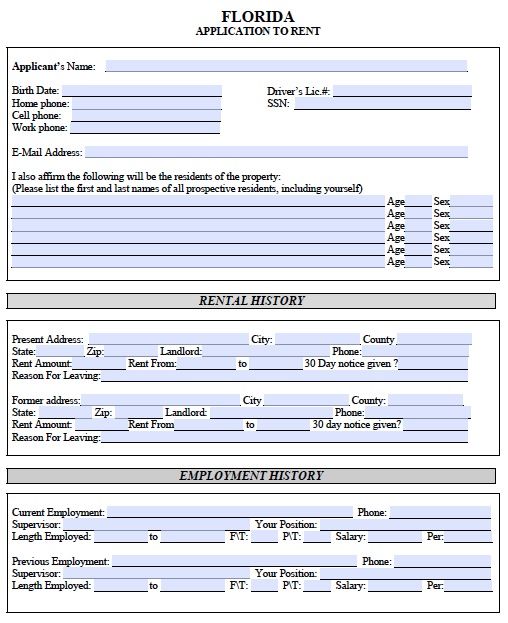

florida condo lease agreement template simple lease agreement

free florida residential lease agreement

free florida residential lease agreement template florida lease

free florida residential lease agreement

create lease agreement templates free florida lease agreement

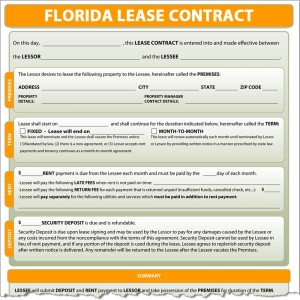

Florida Lease Contract