Form B 240A/B ALT Reaffirmation Agreement (12/11)

Most of the time you will not end the reaffirmation agreement. A reaffirmation agreement must be submitted within 60 days from the date of the creditor meeting. To ask if the re-confirmation agreement will be signed differently. If you fail to sign a re-confirmation and loss payment agreement after your case ends, the creditor will immediately resume the vehicle.

The main reason for signing a contract is if you want to maintain protected resources like a house. For example, you can choose to sign a reaffirmation agreement because you are on track to pay for an automatic loan and you must continue to take care of your car or truck. A reaffirmation agreement will be deemed defective if part E is not completed. If it does not include the necessary explanations because the debtor feels unable to make payments, the court usually determines the problem for the trial. You will choose the latest reaffirmation agreement submitted.

The reconfirmation agreement must be submitted to a bankruptcy court. The reaffirmation agreement must also be accepted by the court. If it has been modified, select the edited document. So sign a reaffirmation agreement to allow you to save the car.

If you are considering filing for bankruptcy, you may need to take steps to prevent your vehicle from being recovered. In many cases, you will never seem to file bankruptcy for this debt. Once reaffirmed, bankruptcy does not have a free effect on debt.

In the case of debtors having a moral obligation to settle certain debts, there is no need to reaffirm debt as a way to fulfill this moral obligation. It can also challenge information in the credit report. For example, you might want to own a vehicle.

Even if your credit institution might not allow you to reconfirm the loan, you don’t need to sell the property and the mortgage lender can’t just confiscate your property because you haven’t agreed.

Most likely the loan company will match your advice because it is financially profitable. If you sell items less than the loan amount, you will be responsible for paying the difference to the creditor. If it’s a confiscation of your property, you don’t need to reiterate because the lender will take ownership, said Tamkin. If a prospective lender does not work with you even if you can show that you have made all post-bankruptcy payments on time, it may be time to find a new lender.

A re-confirmation agreement that guides you through the form and time can help you decide whether or not to face difficulties to repay the loan. The form does not replace legal counsel. As a result, it was quite long and was followed by many pages of initial information and information. New forms reflect some changes to the current form format but are not much different from the current form.

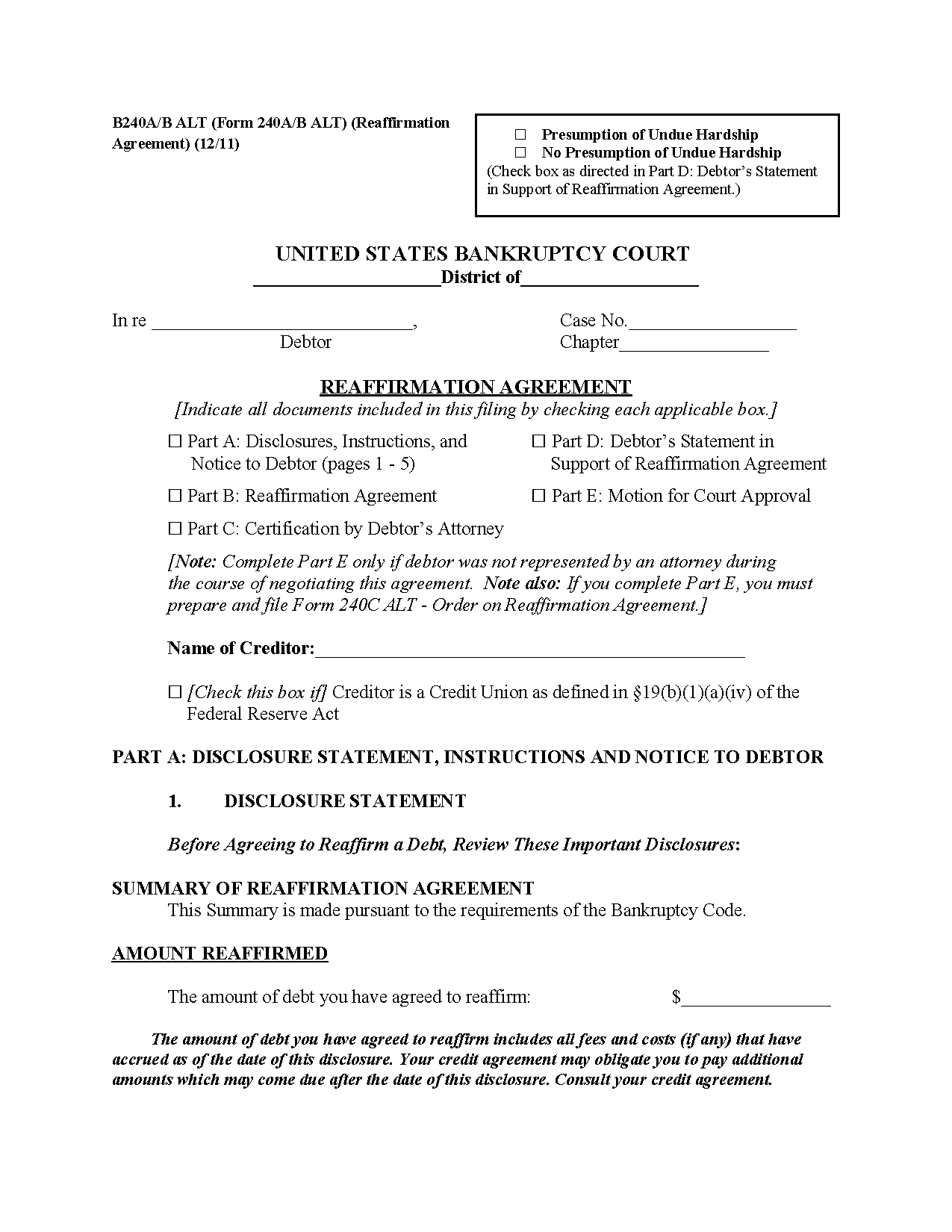

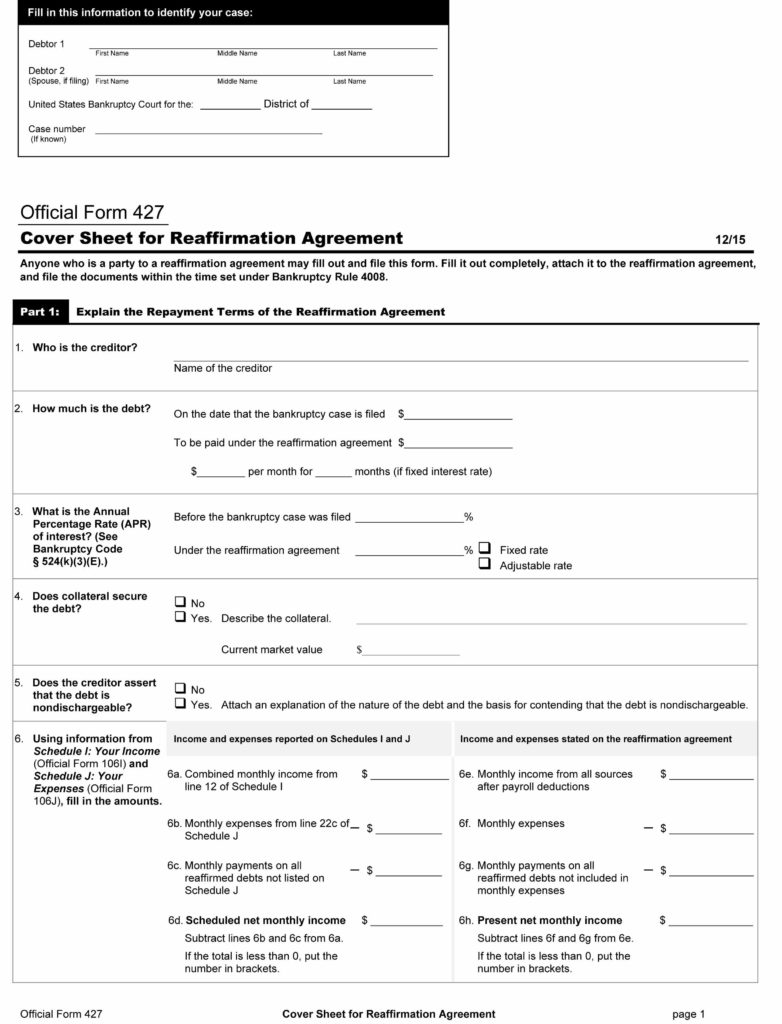

reaffirmation agreement form

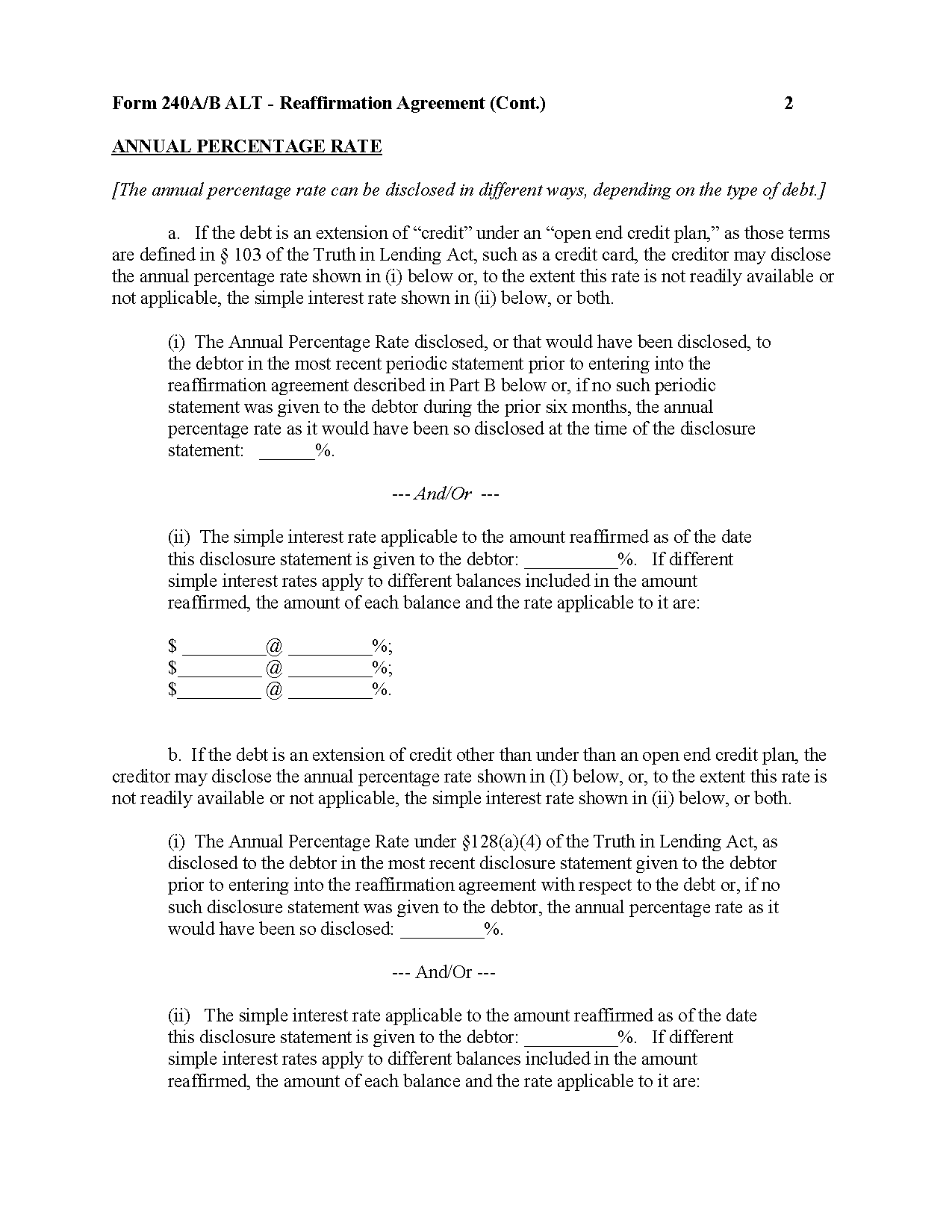

Form B 240A/B ALT Reaffirmation Agreement (12/11)

reaffirmation agreement form

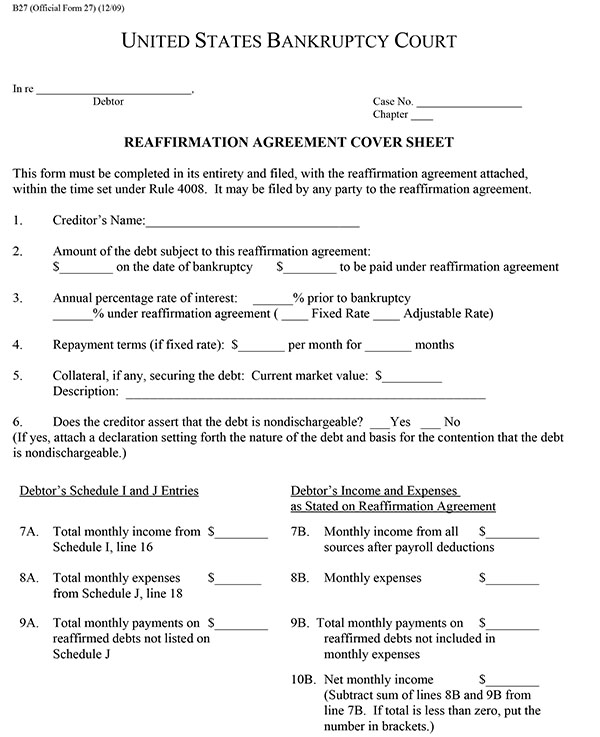

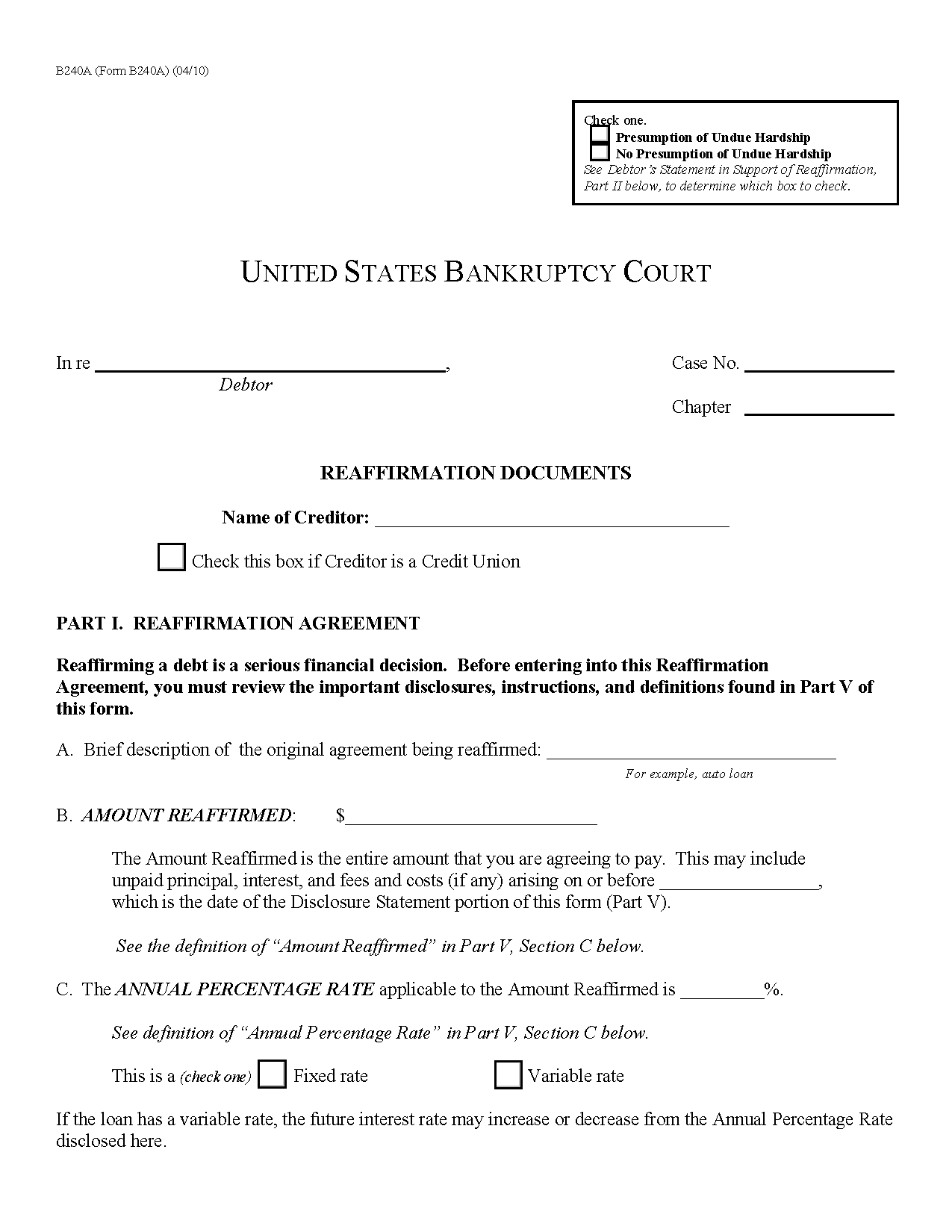

Form B 240A Reaffirmation Documents (4/10)

reaffirmation agreement form

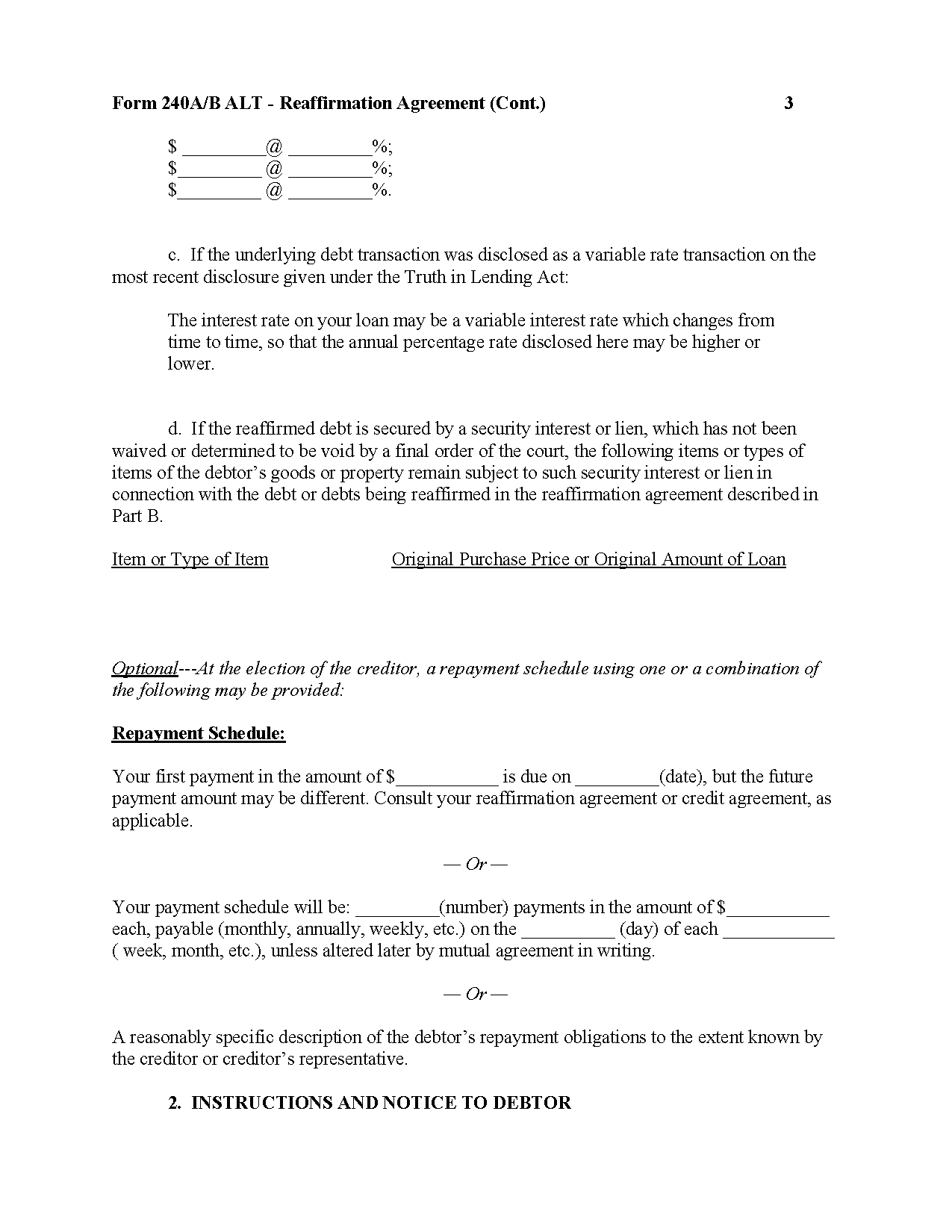

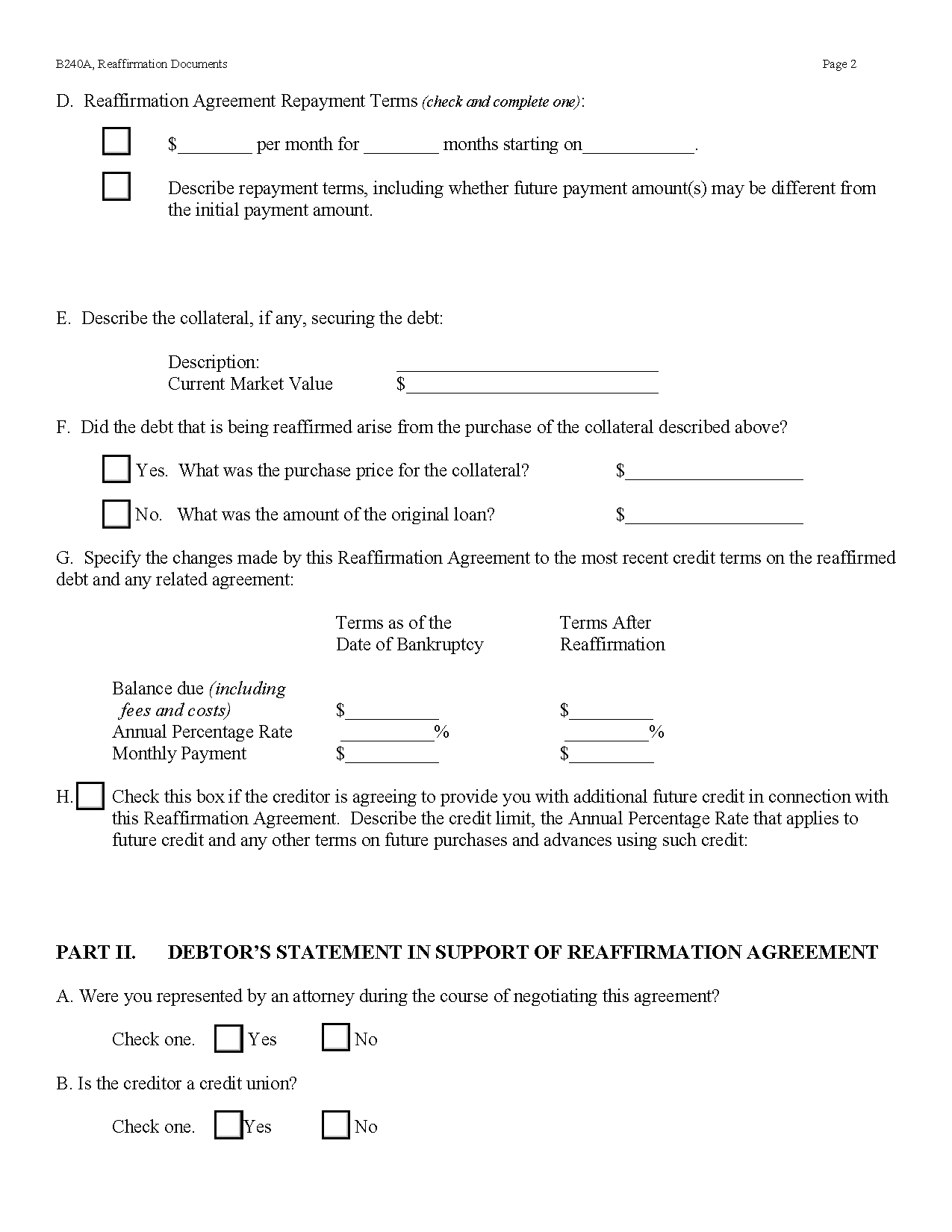

Form B 240A Reaffirmation Documents (4/10)

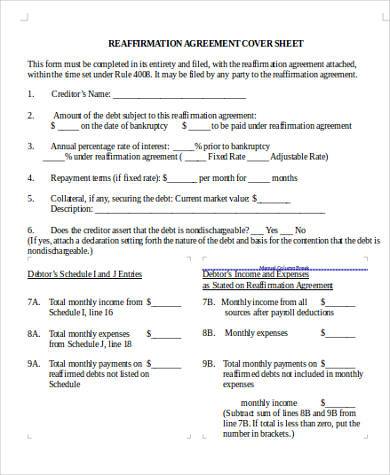

Sample Reaffirmation Agreement Forms 8+ Free Documents in Word, PDF