Investors have to think about the risks of lack of liquidity, the lack of government rights and could end up with security even after the launch of the platform. Normally, the largest investor in a round is known as the leader. Everyone invests because they aspire to find capital in a later round, not because they believe they are likely to get their money back or generate interest income. When investors contribute funds for the project in a SAFT, it is understood that they will find in exchange a certain amount of tokens that should be available in the ICO of the company. The investor and the company can agree on the typical set of terms and conditions without prolonged negotiations, so that the company can obtain its initial financing quickly and economically. Protecting investors while deregulating the mechanism by which a newly created provider raises capital may have become the catalyst for financial recovery.

Within 24 hours you will receive a free investor suggestion, along with the contact details. 3. Some ideas will not attract third-party investors, but it does not indicate that it is a lousy concept, it simply means that it is not the type of business. a third party would like to invest, since they can not find the capacity for the correct return on their investment. The idea is really quite easy. Another essential point to keep in mind is that with a SAFT, investors do not seek to put money into the business or people specifically, but rather the underlying technology behind everything. It may be important to specify the great difference between common shares and preferred shares, which is remarkably relevant when it comes to capital investments.

Ensuring investment is often one of the most difficult pieces. Along with being simple, the initial investments must be really fast. Investors calculate their property from valuation after money. KISS investors usually invest in the business at a fairly early stage, as long as there is a large amount of danger. New investors take actions in the organization, reducing the amount that current shareholders have. Investors in early stages often feel that they are taking on all the danger of companies that are just a team or concept. Additional compelling investors to put money into your company require a great deal of communication, presentation and negotiation skills, and a dedication to due diligence as a way to ensure that both parties get superior treatment.

You may be able to form an excellent company, but not all companies are bankable. In the event that the company is only a notion, and a small investment amount is needed, then angel investors offer the funds. If you have a new company or a current company that you want to develop and grow, you could seek risk financing to provide the necessary capital for the expansion.

Companies offer a series of investment alternatives. For a growing start-up, the company is likely to raise more cash. If you do not have sufficient funds to pay the total amount, the available funds of the company will be distributed to the investors. To comply with the verification requirements, the companies can not rely solely on the self-certification of the buyers, but they are accredited investors. They can use several dynamic price models under the SAFT.

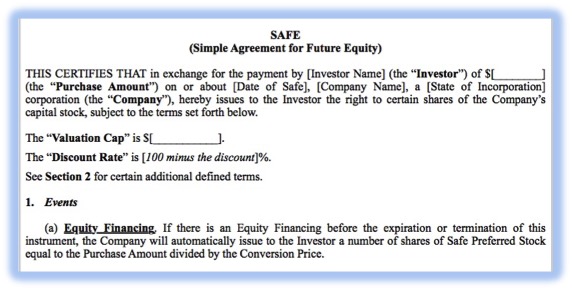

Simple Agreement. Business Loan Agreement Form Simple Agreement

Simple Agreement for Future Equity New Ijerph Free Full Text