SWAP (Encyclopedia)

By : www.bankpedia.org

The way we have established our social agreement allows people to accumulate a large amount of money. A legal agreement must be in place. The agreement between Russia and China will also provide the opportunity to acquire international liquidity when necessary. The fundamental agreement establishes the important principles and the future steps related to the transaction. The agreements listed only incorporate the most recent ones. Therefore, the agreement will act as an additional tool to guarantee financial stability. The currency exchange agreement is intended to guarantee the balance of the current account between the 2 countries and the use of national currencies in trade and investment.

The agreement is intended to promote bilateral trade and direct investment between the two countries, and offer short-term liquidity to stabilize the financial industry. The exchange agreement is an essential prerequisite for the growth of a renminbi market in Switzerland. Although several of the exchange agreements have expired, they continue to be included, since there is a high probability that they will be renewed. It can not be helpful in the general context of weak economic cooperation between Moscow and Beijing. The currency exchange agreement is about to materialize, Honardoost said. The central bank currency swap agreement is a facility designed to allow each of the parties to access the liquidity of the counterparty’s currency without having to obtain the currency in the currency markets.

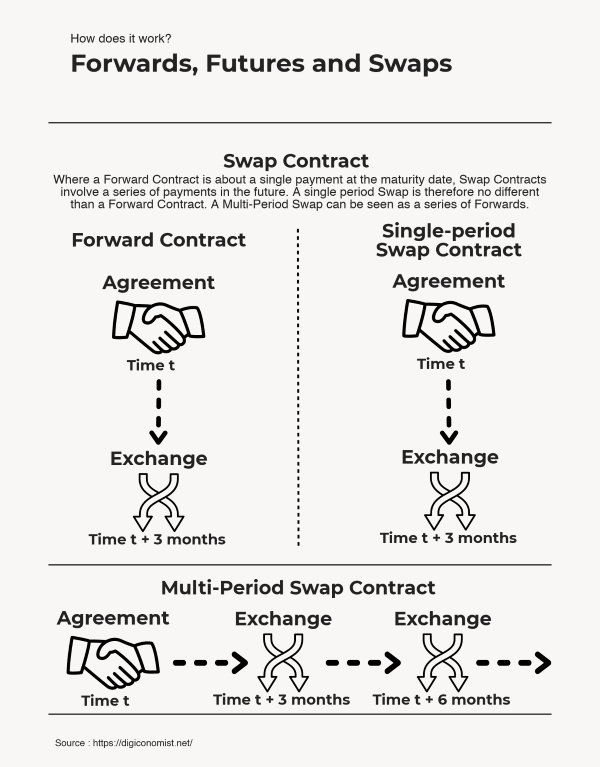

In general terms, there are numerous different assortments of swaps, each with its own amount of complexity and popularity. Although it is an integral component of the global derivatives market, many types of swaps are still controversial. Used correctly, changing the interest rate is a useful and flexible tool for the interest rate risk manager.

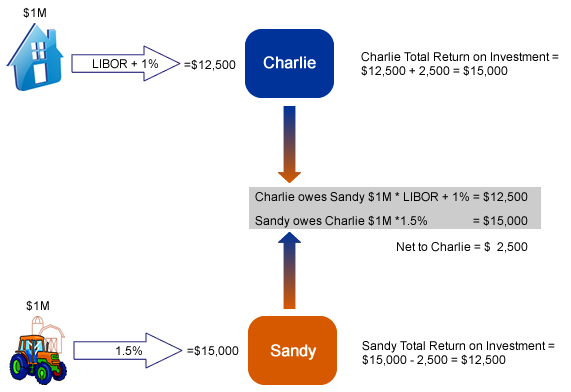

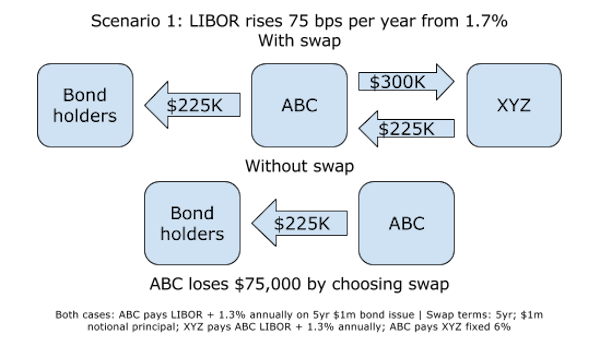

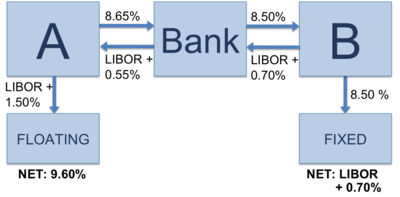

The simplest approach to observing how companies can use swaps to manage risks is to follow a very simple example that uses interest rate swaps, the most frequent type of swaps. Interest rate swaps became an important tool for several types of investors, along with corporate treasurers, risk managers and banks, since they have as many possible uses. That means you could imagine an exchange of interest rates for a bet on interest rates.

Swaps can depend on interest rates, stock market indices, currency exchange prices and possibly even commodity prices. There is no panacea for narrow credit spreads. There are some things that swaps can not do. What is important not to forget is that swaps are extremely popular derivative instruments used by parties of all types to meet their particular investment strategies. Interest rate swaps are the most frequent procedure for hedging exposures to changes in the interest rate. A simple exchange of a single interest rate for another is just a strategy that could be carried out.

Swaps can easily be obtained for almost any period of time between six months and twenty-five decades. Actually, conventional swaps do not have the same period. Simple vanilla swaps are the type of swap executed most often, and it is often a viable process of actively managing risk when profits are made.

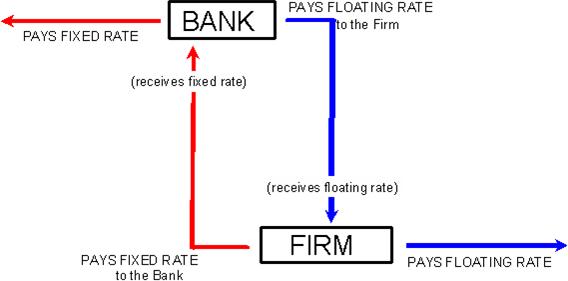

Swaps are used to control risk in several ways. They are an excellent way for companies to manage their debt more effectively. In most cases, interest rate swaps incorporate the exchange of a fixed interest rate for a floating rate. In the same way, they can be used to convert a floating interest rate to a fixed interest rate.

swap agreement

By : www.investinganswers.com

swappingagreementsample

By : www.slideshare.net

swap agreement

By : www.quora.com

Swapping Agreement sample

By : www.slideshare.net

swap agreement

By : www.investopedia.com

Differences between Swaps, Forwards and Futures

By : digiconomist.net

Swap (finance) Wikipedia

By : en.wikipedia.org