A Cross Purchase Buy Sell for Businesses with Multiple Owners

By : us.axa.com

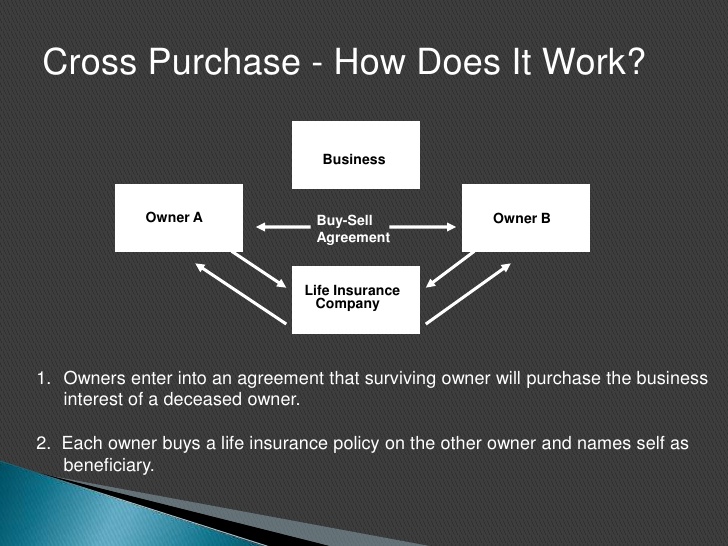

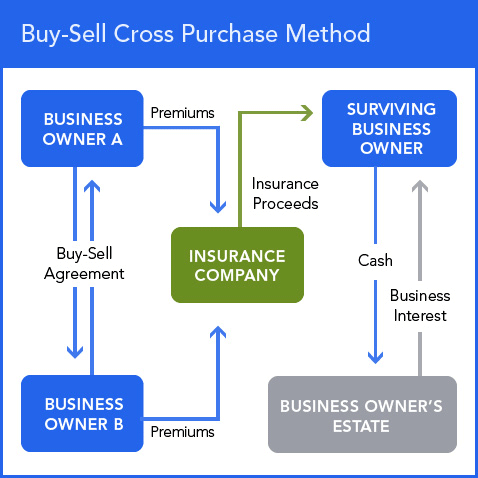

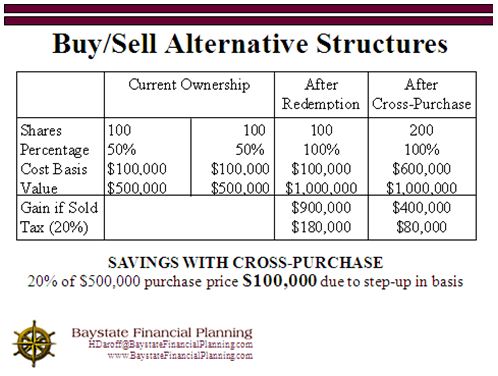

If there is no agreement, your co-owner may not want to buy your part in the company, which you are interested in offering your shares to a third party with a value below the real value of your share due to desperate circumstances. In addition, the redemption agreement increases the remaining shares of the owner without increasing the base, which can lead to higher taxes. They must sell their interests. This allows or requires the company to regain interest in the owner. On the other hand, it can be easy to manage when life insurance is involved, so determining the type of agreement requires careful consideration. When you apply for a cross purchase contract or an inventory exchange program, an insurance policy for the guarantor of the company will analyze the value of your business to ascertain how much coverage is available to the owner.

Contrary to what most people think, sales agreements do not involve company purchases and sales. They can help protect your business and your family.

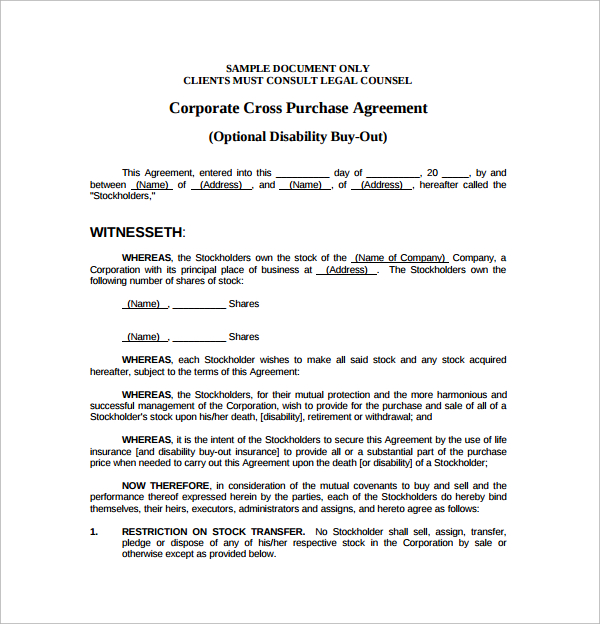

Purchase and sale agreements can consist of provisions that prevent shareholders from transferring their shares or entities that are not permitted to shareholder companies. If your purchase agreement is not set up correctly, it can cause a lot of pain for your coworkers, their family members and your relatives. For entrepreneurs, buying and selling agreements can be the most important planning tools they can ask for. Providing protection for family business owners so as not to lose control of their business. Tell us if you want to know more about preparing a purchase agreement for your family business.

The agreement doesn’t have to be right. This also describes the terms and conditions for which the purchase price will be paid. This does not determine the price difference between two types of shares.

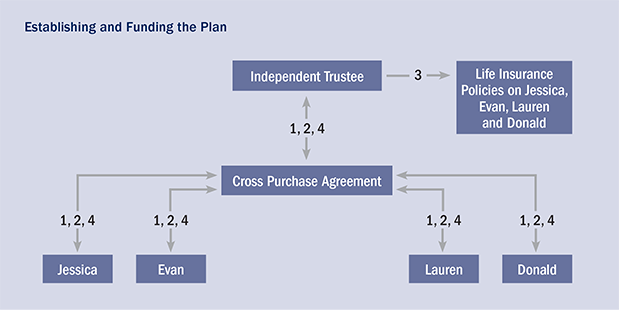

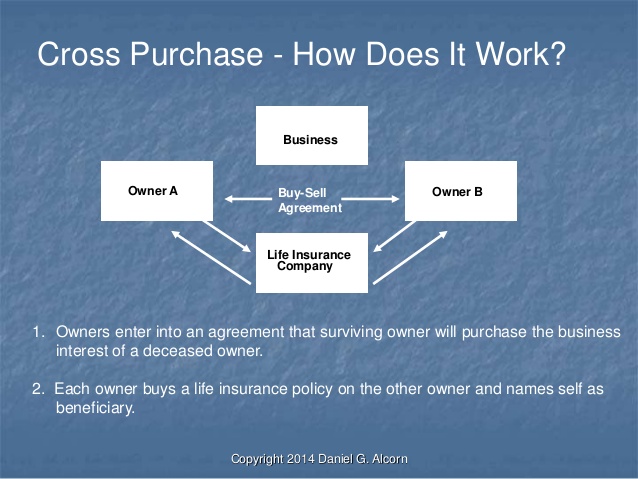

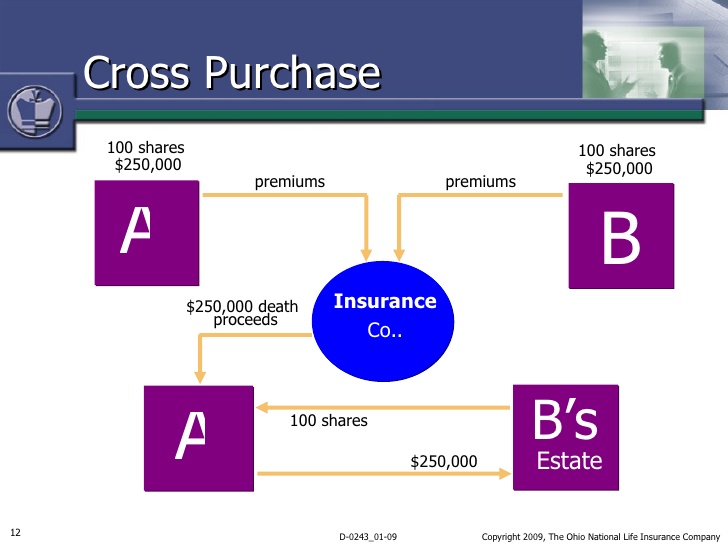

A cross purchase agreement is an agreement used by business partners who will become owners of the company. Alife Cross’s life insurance agreement is something that is usually found in the industrial world today.

In order for the sale and purchase agreement to function, it must be financed to ensure that capital can be found at the right time from the death of the spouse. This can determine business value, ensure that there are buyers for business and increase creditworthiness of the business. Usually determined when the owner is authorized to sell his interests, who is authorized to buy and how to determine the price to be paid. Purchase and sale agreements are usually used by business owners. Purchase agreements are an integral part of succession planning. Making a sale and purchase agreement must be designed and implemented by a lawyer. The first step in building a sales life insurance agreement for your business is to learn the general value of your business.

cross purchase agreement

By : www.slideshare.net

Cross Purchase Agreement Template sarahepps.

By : www.sarahepps.com

cross purchase agreement

By : www.sampletemplates.com

Buy Sell Agreements Funded with Life Insurance

By : www.slideshare.net

cross purchase agreement

By : www.sarahepps.com

Cross Purchase Agreement Template sarahepps.

By : www.sarahepps.com

Ogden Financial Planners

By : ogdenfinancial.com