Free New York LLC Operating Agreement Forms PDF | Word | eForms

If you are planning to start a business (or when you have already started a business), we can help you with documentation that you must be prosperous. Starting a provider is an inherently legal procedure. As soon as you form your business, you want to establish the conditions of your government. As long as you have established a US company, your private place of life is not associated with the information requirements.

If you have not yet incorporated your organization, your personal assets are automatically linked to your company. To know the purchase price and finance it with adequate insurance, it is essential to understand how much the company would be worth. Instead, the company will go directly to its new owner. Companies must file income tax returns on time, regardless of the amount of net income. If you started your business with friends or colleagues, you should agree with the timing and value of the sale of your business. To acquire an analysis of the value of the business, small businesses may want to hire an expert appraiser.

When you incorporate your company, it is not just your name that you are protecting. One way to protect your business from divorce is to sacrifice different assets to maintain it. Finally, while preparing to do business in the United States, it is essential not to overlook the non-commercial implications of preparing a store in the US. UU From protecting your personal assets to making sure you have a mandatory global real estate program, you’ll need to make sure you’ve taken every one of the essential steps to make sure your assets are safe. For example, if you started your business before marriage but your spouse makes it possible to get new customers, you may qualify for part of the increase in value. Let’s say you want to pass your business to your son or daughter as you get older, but you only want to do so in case of a sudden illness. As long as your company is a corporation, although it still manages it, it is your own entity. In several ways, attracting external investors is very similar to selling the business (in reality, many investments involve selling a part of the company’s shares).

Some states do not need to file a state tax return in any way. Nor do they allow professionals whose occupation requires a license to form LLC. Each state has different standards regarding what type of business activities require registration. The condition of the training is not required to be the state in which the owner resides, and she can choose the state with the laws that are most favorable to her circumstance.

The cost of conducting an extensive valuation of small businesses can range from a couple of thousand dollars to $ 50,000 or more. It’s around $ 1,000. Obviously, there are additional expenses related to the transfer of ownership of real estate as well, and there really is no reason not to develop and implement an asset protection strategy before buying.

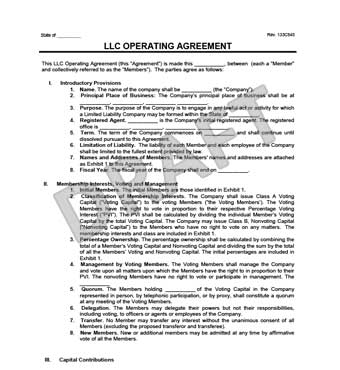

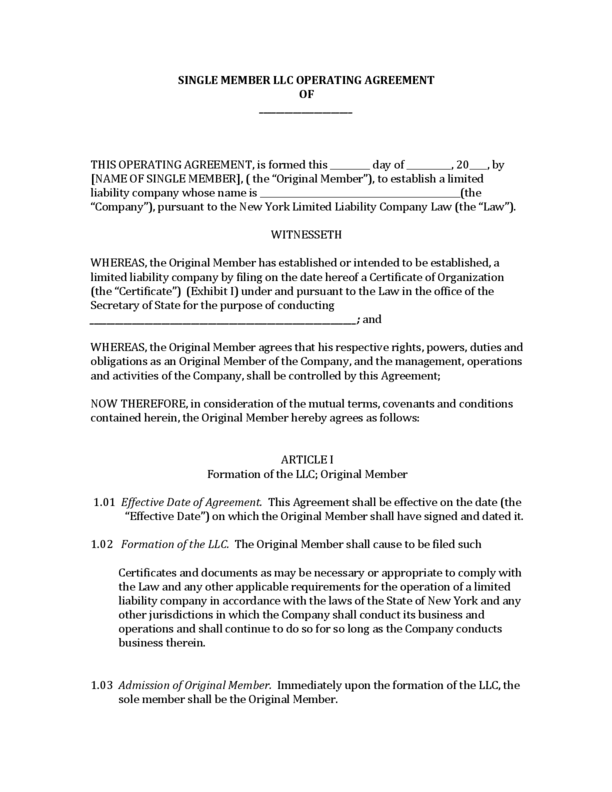

llc operating agreement ny

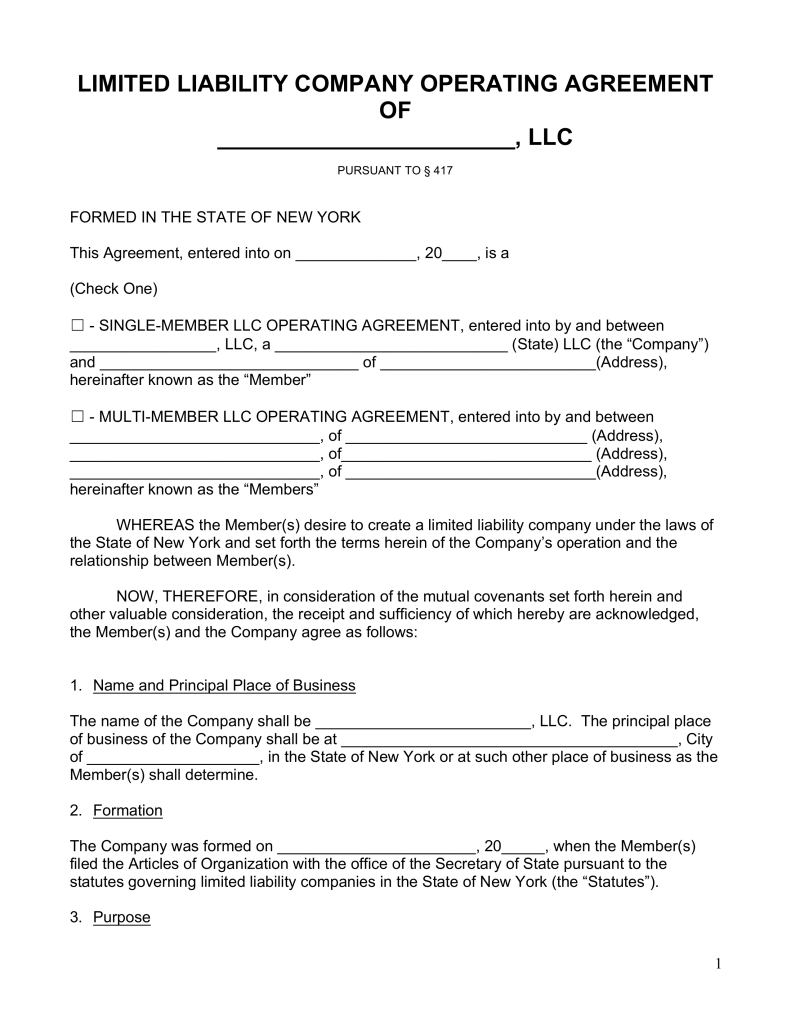

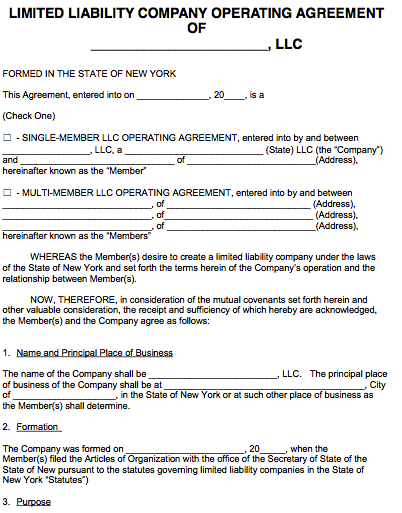

new york single member llc operating agreement template operating

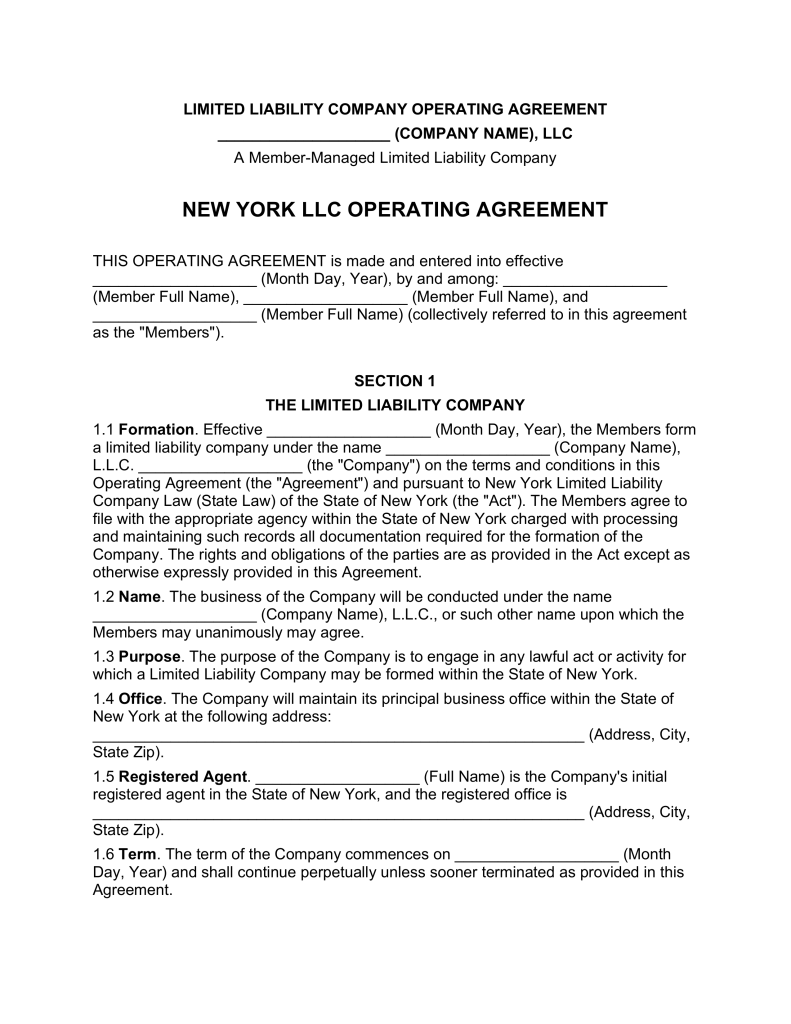

llc operating agreement ny

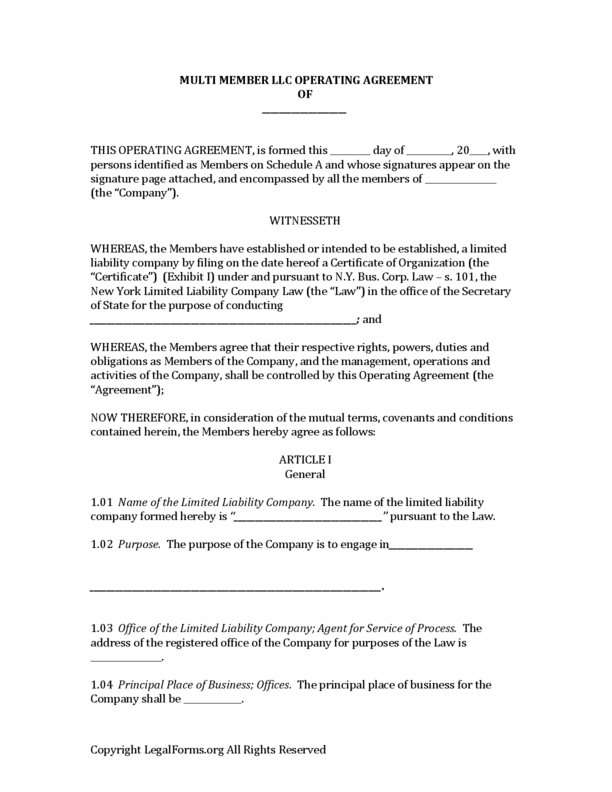

New York Multi Member LLC Operating Agreement Form | eForms – Free

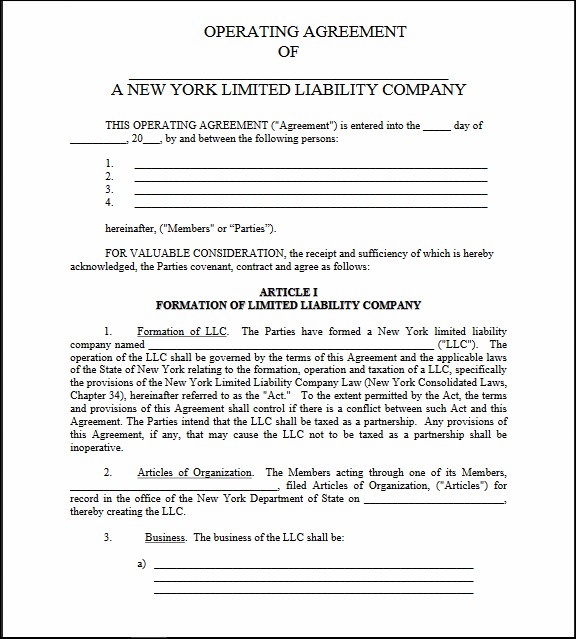

llc operating agreement ny

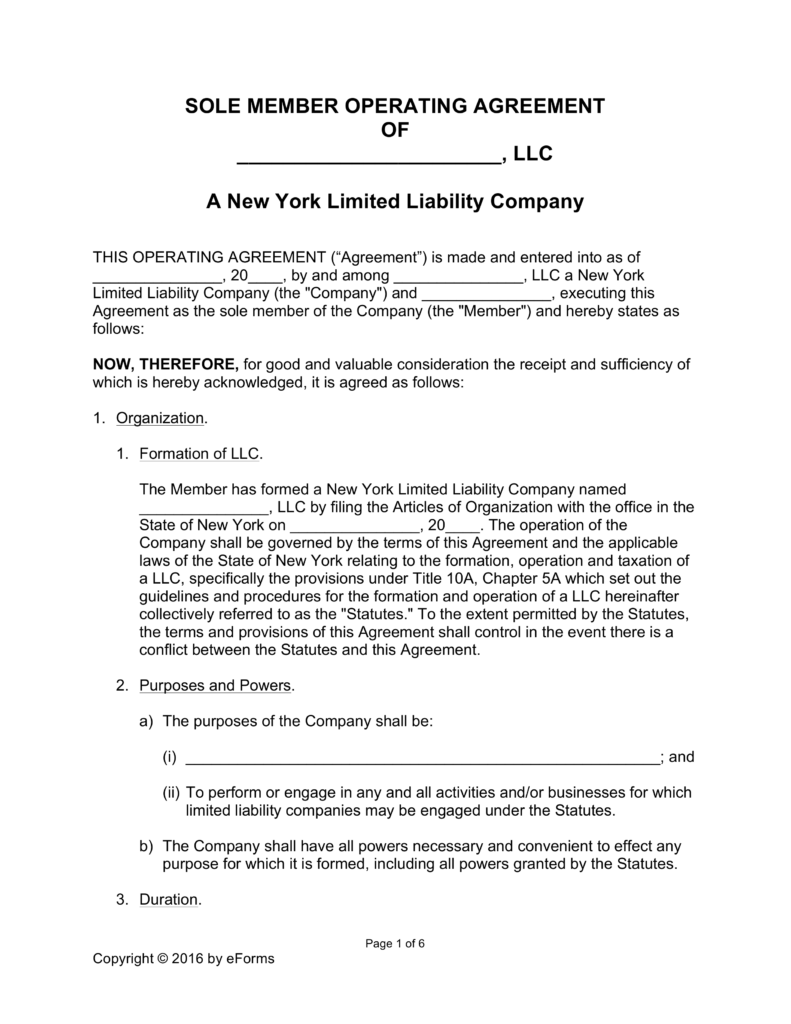

Free New York Single Member LLC Operating Agreement Form Word

profits interest llc operating agreement Ecza.solinf.co