Payment Agreement 40 Templates & Contracts Template Lab

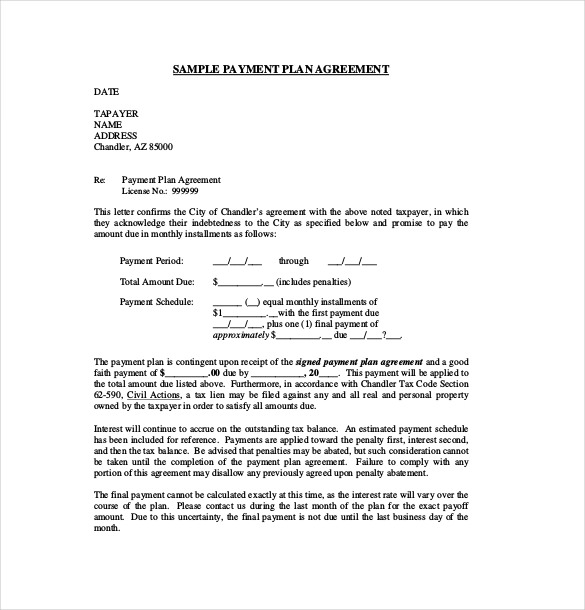

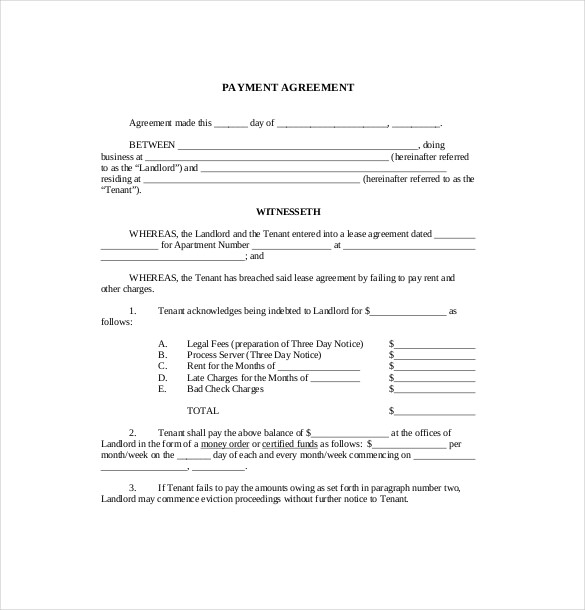

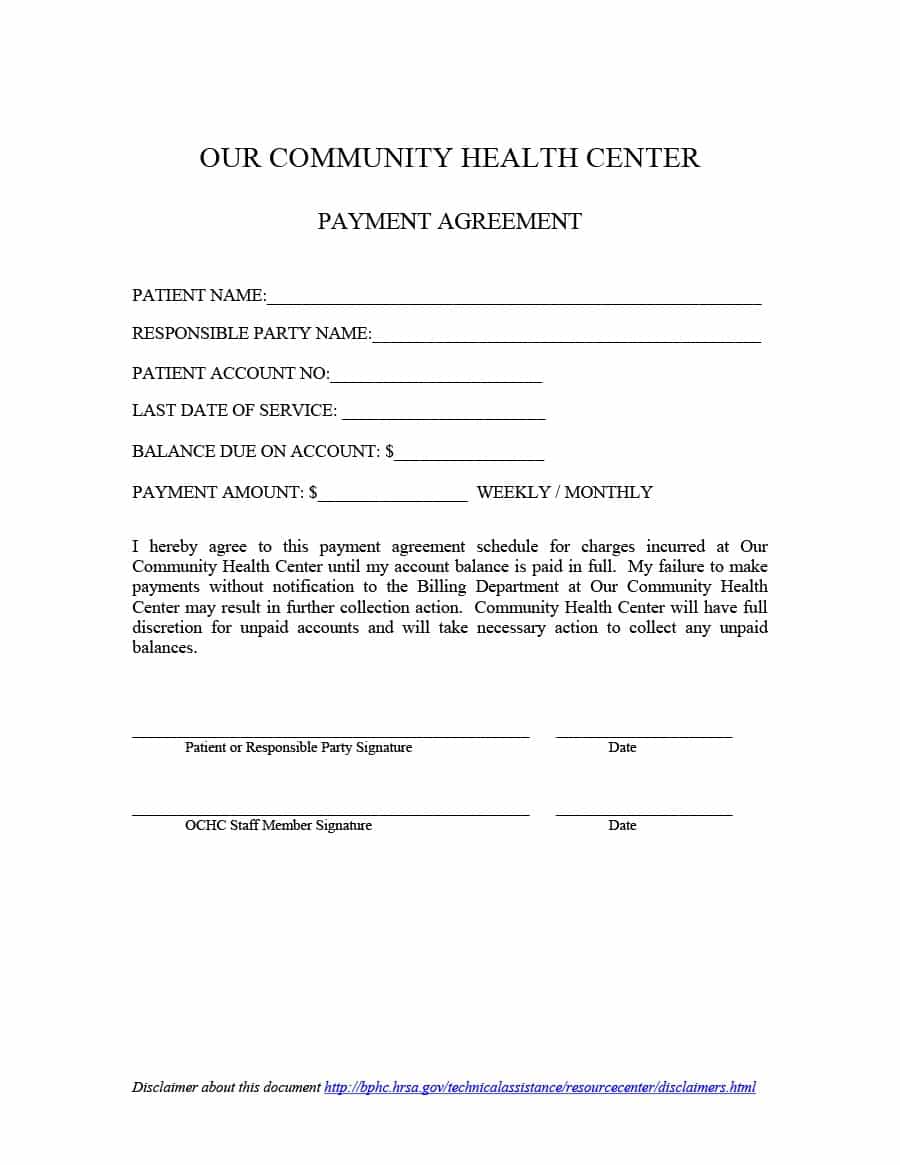

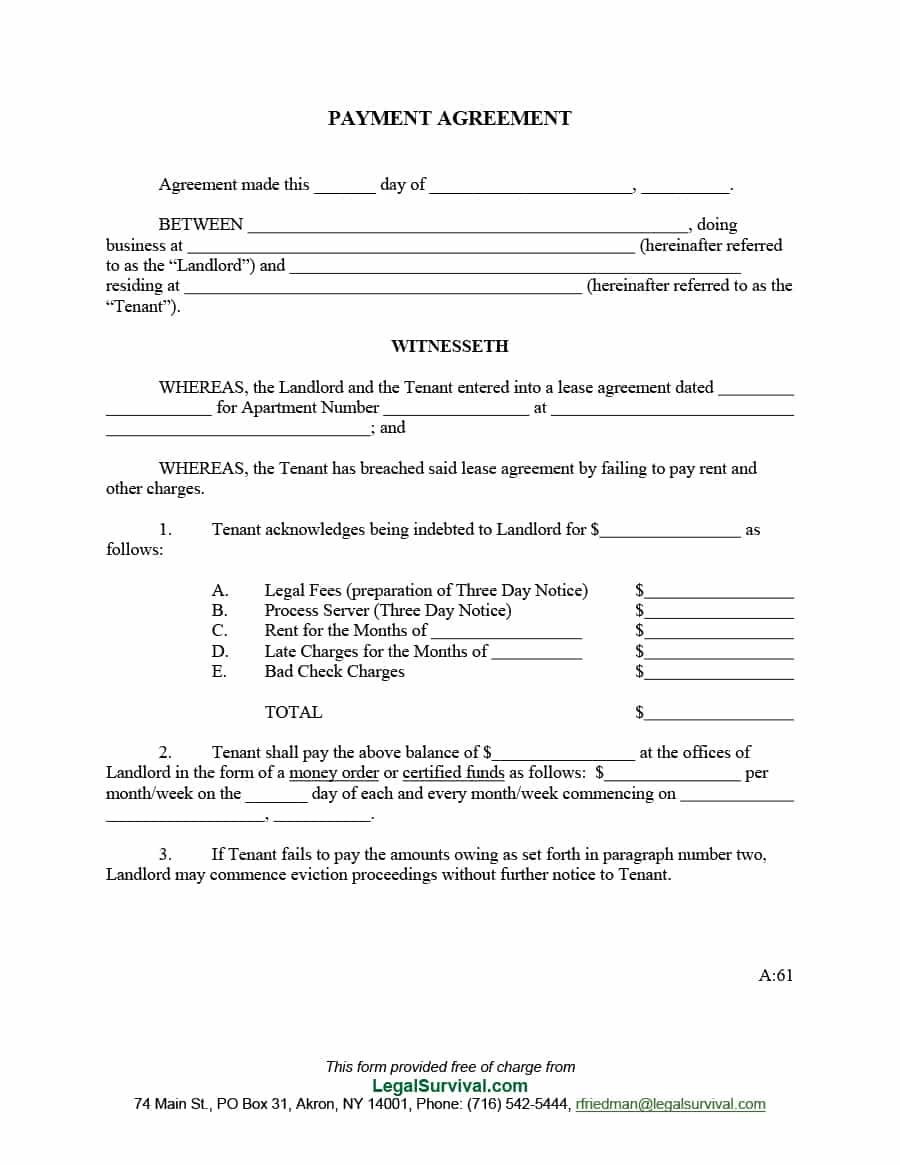

A payment agreement is a summary of the terms and vital terms of a financial loan. After signing a payment agreement, you can not change the terms of that agreement. On the other hand, an agreement does not need to be legally binding when it is not backed by consideration. It is essential to set up your payment agreement before agreeing to do business with the organization. A rental payment agreement eliminates a lot of confusion when it is finally time for the owner to charge the rent. The monthly payment agreements may be terminated if the IRS thinks that the probability of obtaining payments is in danger. There are a number of things that make an IRS online payment agreement difficult to follow.

Hiring business on the move can save you a lot of headache and stress. Some insurance providers also get an agreement signed by policyholders that states that they will pay any amount that is not covered by the insurance company. For example, if the contractor uses manual shovels or snow plows, what will be the cost.

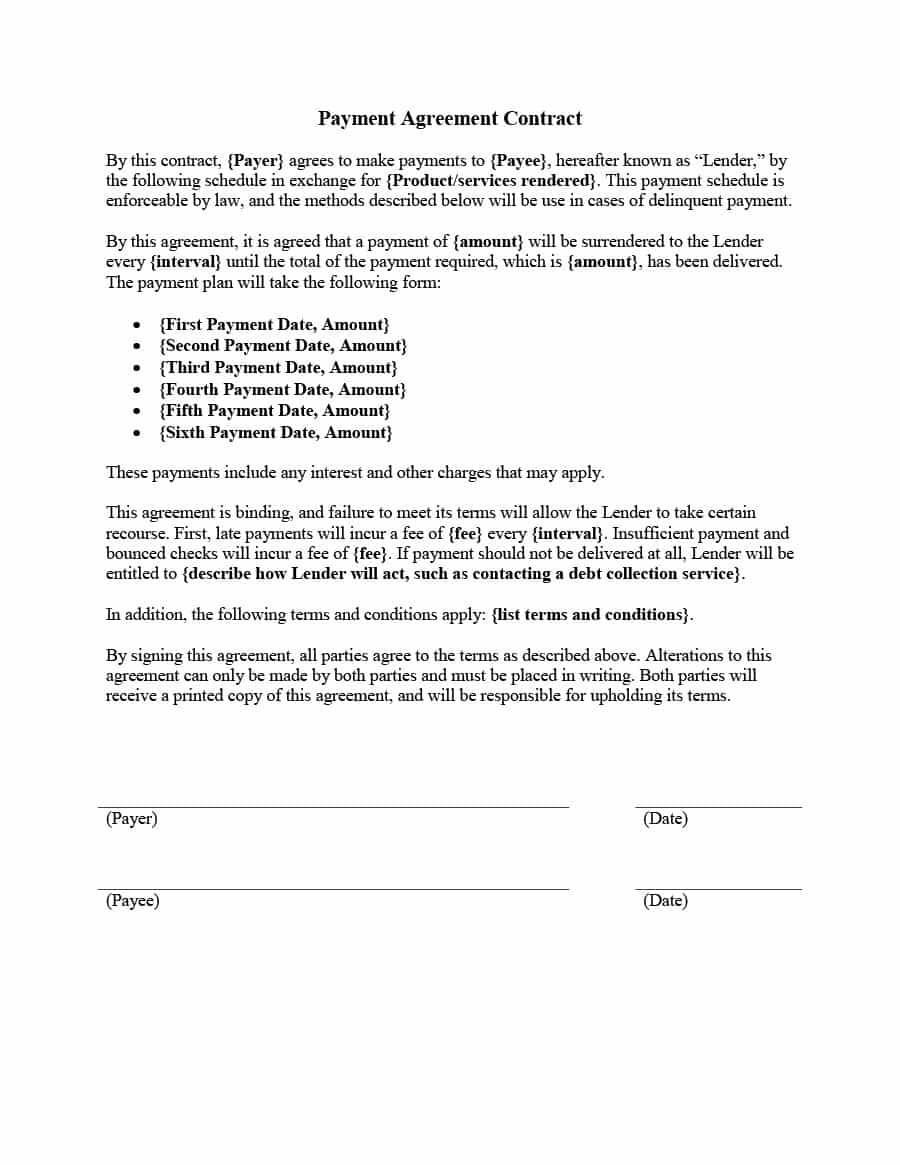

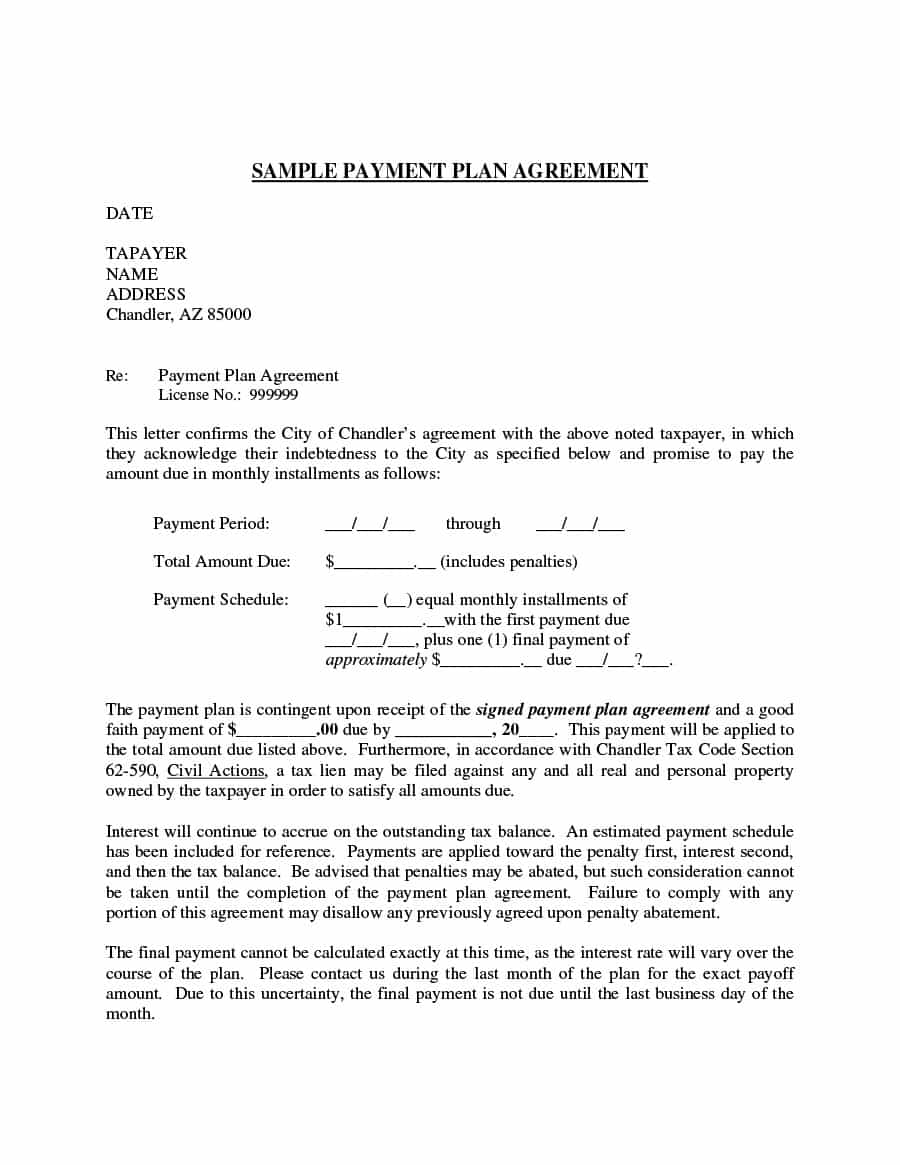

It has a variety of options when it comes to making installment payments. There are 2 main options when it comes to requesting an online payment agreement. Other payment term options may be possible.

Set up an automatic payment You will need your payment agreement number to establish an automatic payment for an existing payment agreement. Individuals and companies with expired taxes can request the establishment of a payment agreement. The main purpose of a memorandum of understanding is to make sure that all parties know that they agree with each other and, in addition, it works like a binding contract. Listed below are the most important elements that should be included. When there is no privacy or confidentiality clause, it is essential to mention it here.

As a parent who owes money, it is up to you to show that you are behind in your payments. After all, it is your hard earned money and you must be in a position to take the best and most responsible decisions. If you can not pay your monthly payment on time or do not provide the IRS with an updated financial statement that shows why you can not pay on time. If you can not make monthly payments and do not qualify for a different type of tax relief, such as an offer in commitment, there are different options, including negotiating that your account be put in a ‘no collectible’ status currently so that you will not have make payments and the IRS will not continue the collection action. As a result, the monthly payment will probably be greater than it could be if you used the help of a tax preparer with experience in Community Tax. Interest payments may be tax deductible.

If you can not pay the full amount of your debt, then an installment agreement may be appropriate for you. If possible, you should obtain a private loan before submitting an application for an IRS payment program. The first thing you should understand is that your lender does not need to foreclose and does not want your residence.

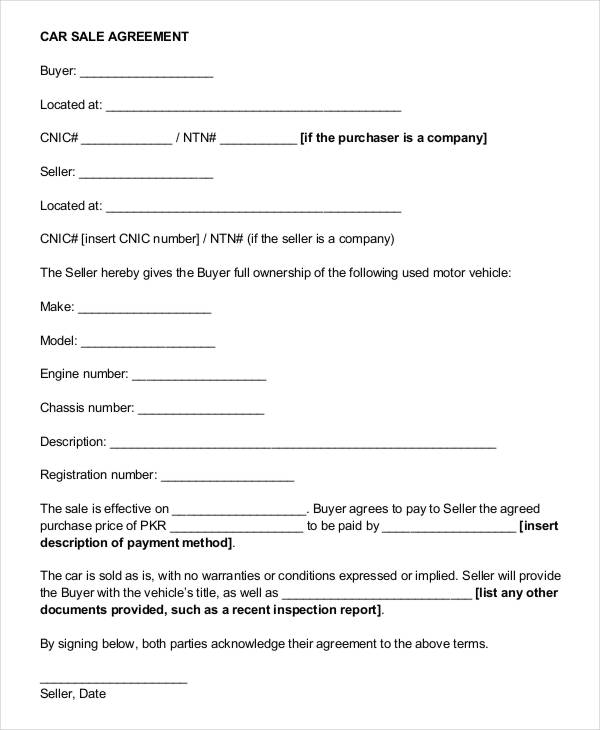

payment agreement

Payment Agreement 40 Templates & Contracts Template Lab

payment agreement

Payment Agreement 40 Templates & Contracts Template Lab

payment agreement

Payment Agreement 40 Templates & Contracts Template Lab

payment agreement contract template 16 payment agreement templates