Single Member LLC Operating Agreement Template | Rocket Lawyer

The company must have sufficient freedom to make films and be very clear about its authority to operate and to the functions of investors. – Members generally must be restricted. When you have made an American company, your place of residence is not related to the reporting requirements. Despite the lack of luxury, among the most important things a fitness company can do to look after itself is to choose and maintain an ideal legal structure.

However, if you are in an LLC, creditors may be limited to putting money in your place. LLC does not issue shares, but equity is provided in the form of goods. If you choose to make an LLC for rental property, be sure to renew the rental fee.

If you have an LLC, you can ask for an office and it’s easy enough to be in your private residence. One might ask if you have to make an LLC before or after you buy a rental property. An LLC is not just to own assets. For tax purposes, your main parent company LLC is a single tax return.

In general, the application of a formal legal structure indicates that you are interested in protecting and developing your business. If you manage activities with different people, but in the same way without an official commercial structure, you are considered a partnership. Every company has its own licenses and licenses for small businesses, so it’s up to partners to seek their permission according to their company. So, you are ready to start preparing business in Orange County, CA.

Tax Management A big advantage of an LLC includes taxes. The advantage of producing an LLC is that you don’t have to have your name on the property deed. One of the main advantages of LLC is the ability to model company interests to characterize investor interests and director’s needs.

LLC is a preferred vehicle because it gives the owner maximum flexibility regarding the arrangement of controls and financing when reducing not only liability but also in addition to tax obligations. In addition to tax benefits, it also allows you to have a basic level of asset protection. The LLC and the series can be arranged according to how they are managed. An LLC or company incorporated in your country or base is a very good means of life.

When LLC is applied, an operating agreement is being made for each LLC member. Once the LLC is established through a state agent, it has no owner. You can make your LLC and only pay taxes if you have income.

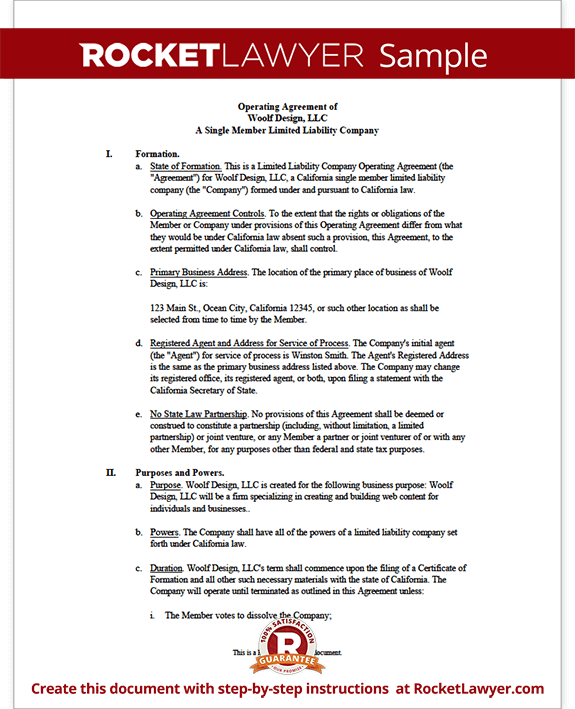

sample single member llc operating agreement

Write a Free Single Member LLC Operating Agreement | PDF | Word

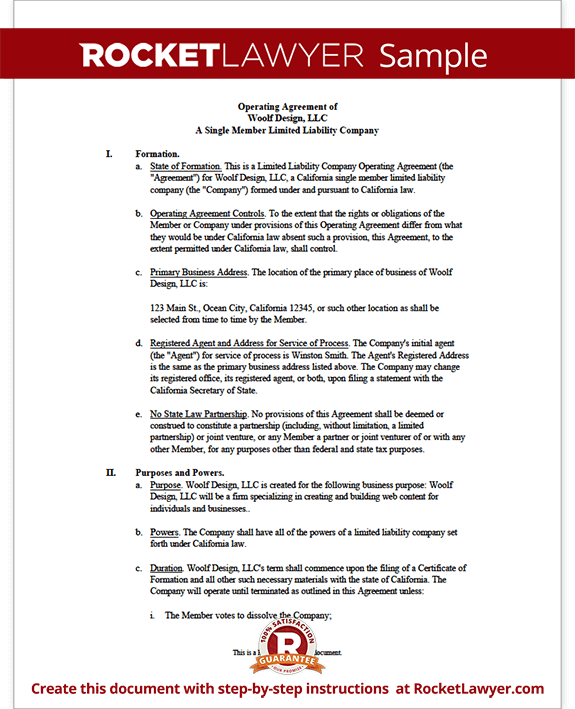

sample single member llc operating agreement

Free Ohio Single Member LLC Operating Agreement Form Word | PDF

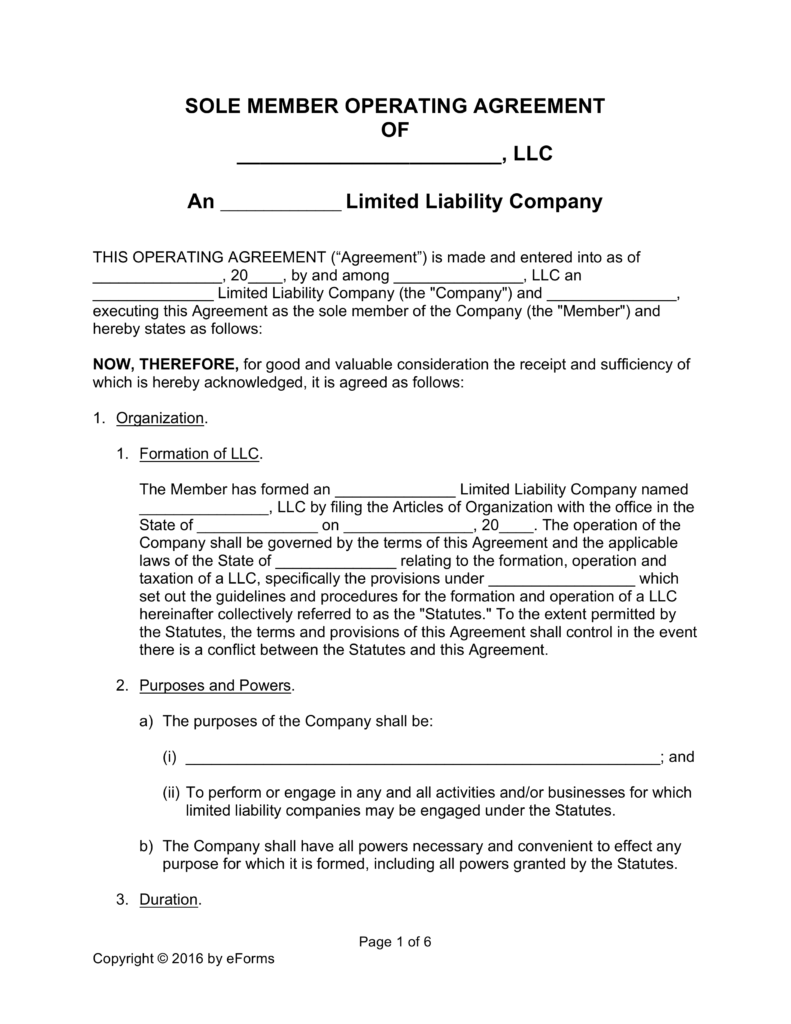

sample single member llc operating agreement

operation agreement llc template two member llc operating

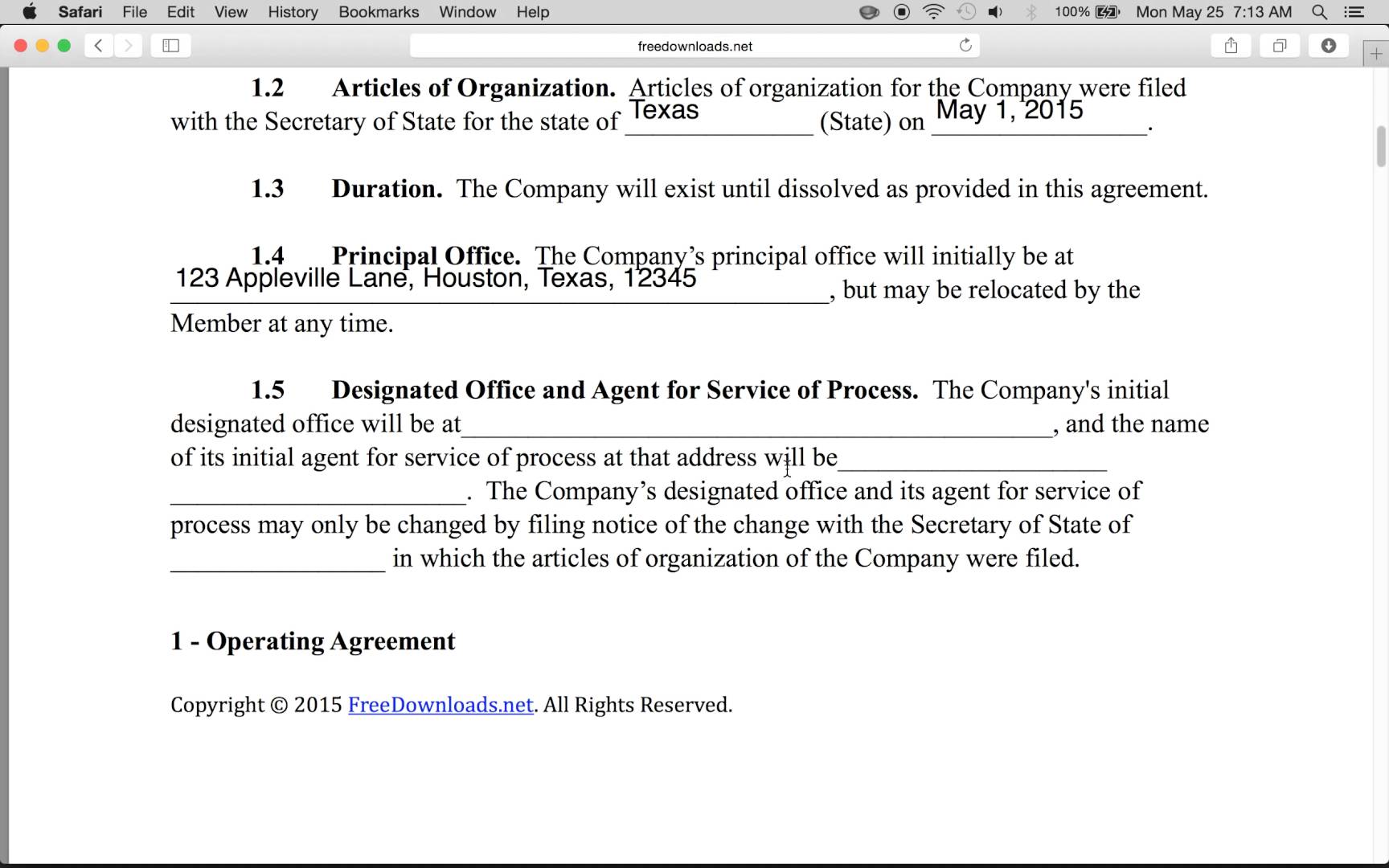

Operating Agreement