Is the IRS Online Payment Agreement Site Down? Absolute Computers

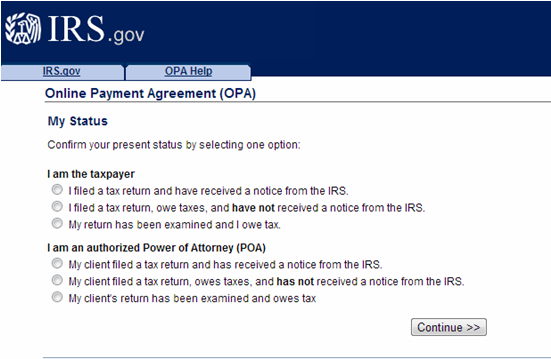

You can apply online for a short-term payment agreement online or by phone. Instead of calling, you can apply online. If you prefer, you can request a payment agreement online.

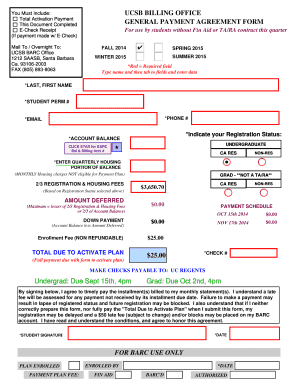

You must make your payment on the same day every month. Make a decision about which day of the month you want to make your payments. If you know you are not likely to create a payment due to unforeseen difficulties, talk to the IRS whenever possible to stay away from possible collection actions. Your minimum payment will be the total of your balance divided by 72. It will be your total bill divided by 72. It will be deducted automatically from your account every month.

If you decide to make your payments through payroll deduction, you can not send Form 9465 electronically. Disclosures The first time you initiate payments through the online payment service, you will be asked to confirm your acceptance of the Agreement. When the payment is completed, verify exactly the same on the receipt. You can also arrange for EFTPS to automatically produce your monthly payments. Monthly payments can be produced by mail, telephone or on the Internet. As a result, the monthly payment will probably be greater than it could be if you used the help of a tax preparer with experience in Community Tax. You have to pay at least the minimum monthly payment on time.

If you selected a preferred online payment method, it will be displayed as the key payment system when making a purchase or sending money through products and solutions. Payments are due and must be made in accordance with the Offer Details for Subscription. You do not need to enter a down payment if you make a claim based on the doubt as to liability. Similarly, if you are self-employed, you must be up-to-date on your estimated quarterly tax payments for the current year.

After breaching an installment agreement, it is substantially more difficult to get the IRS to accept some other installment agreement. Depending on your situation, you may be able to submit an application for an installment payment agreement through the IRS online portal. Installment agreements are the most common when you can not pay your taxes on time, says Hockenberry. The installment agreement can put you back in charge of your financial future. Although the agreement, which establishes an installment payment account for qualified individuals, may be beneficial in some cases, it may not be the correct option for each and every one of the taxpayers.

A payment agreement is a summary of the critical terms and terms of a financial loan. As soon as you enter into a payment agreement, you can not change the terms of that agreement. It is also possible to obtain a sample payment plan agreement that accompanies the examples included in each of the blocks.

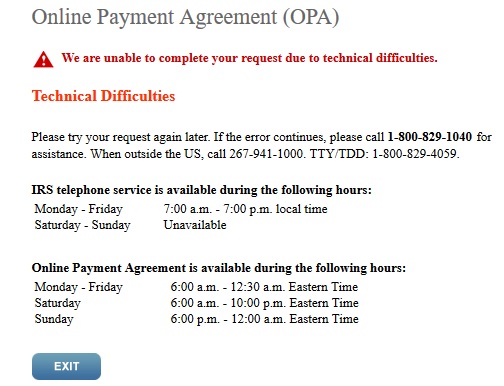

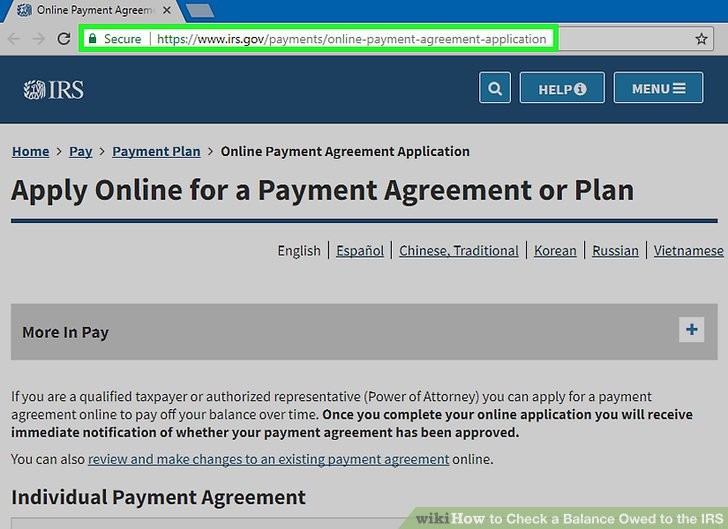

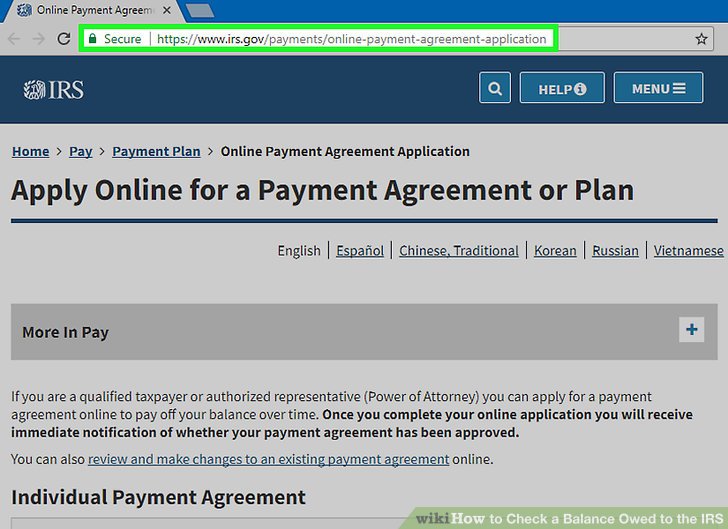

The agreements can fall apart, therefore, as long as it is money, you must ensure that you are protected. In addition, the agreement can also be terminated if you file future tax returns or if you do not pay. The Payment Agreement works like a promissory note that involves you and McMaster, in which you agree to cover the fees, as they calculate at the correct time of confirmation. The Internet payment agreement may not be approved under all conditions. The information you must have when using the Online Payment Agreement is here. The IRS online payment agreement will allow you to pay the amount owed in monthly installments over a period of time.

online payment agreement

Online Payment Agreement Fill Online, Printable, Fillable, Blank

online payment agreement

Information About Online Payment Agreements | US Tax Center

online payment agreement

Irs Online Payment Agreement Login Lovely 3 Ways To Check A

Payment Plans, Installment Agreements – Changes to User Fees